An in-depth look at different scenarios leading to devastating bills

52% of their income

on healthcare. Choosing a Medicare plan can be stressful, but not as stressful as one sudden event escalating your medical bills beyond your control. As the old insurance adage goes, you can’t buy fire insurance once the house has already gone up in smoke.Stay Up to Date on Medicare!

Know Your Options

Door 1 - Original Medicare: Parts A & B

- You are responsible for the Part A Deductible of $1,600 per 60 day benefit period for Hospital Coverage, the Part B Monthly Premium of at least $164.90 depending on your income, and 20% Coinsurance (Medicare will cover the 80%) for Medical Coverage.

- You can visit any hospital that accepts Medicare.

- OM is the bare-bones package. Maybe you have a retirement health insurance plan that can pay secondary. If you go with this option, you are essentially paying the least upfront while leaving yourself most exposed to potential risks.

- Drug Plan (Part D) is not included; it can be purchased separately.

Door 2 - Medicare Advantage

- You might have low or no monthly premium with some plans, but you will be responsible for the Maximum Out-of-Pocket Costs which are stipulated by your insurance carrier for each year you are on the plan.

- There are two types of plans:

- HMO - in-network only. If you pursue care outside their network, you will pay the cost totally out-of-pocket.

- PPO - you can pursue out-of-network medical services but you may pay a higher cost-share.

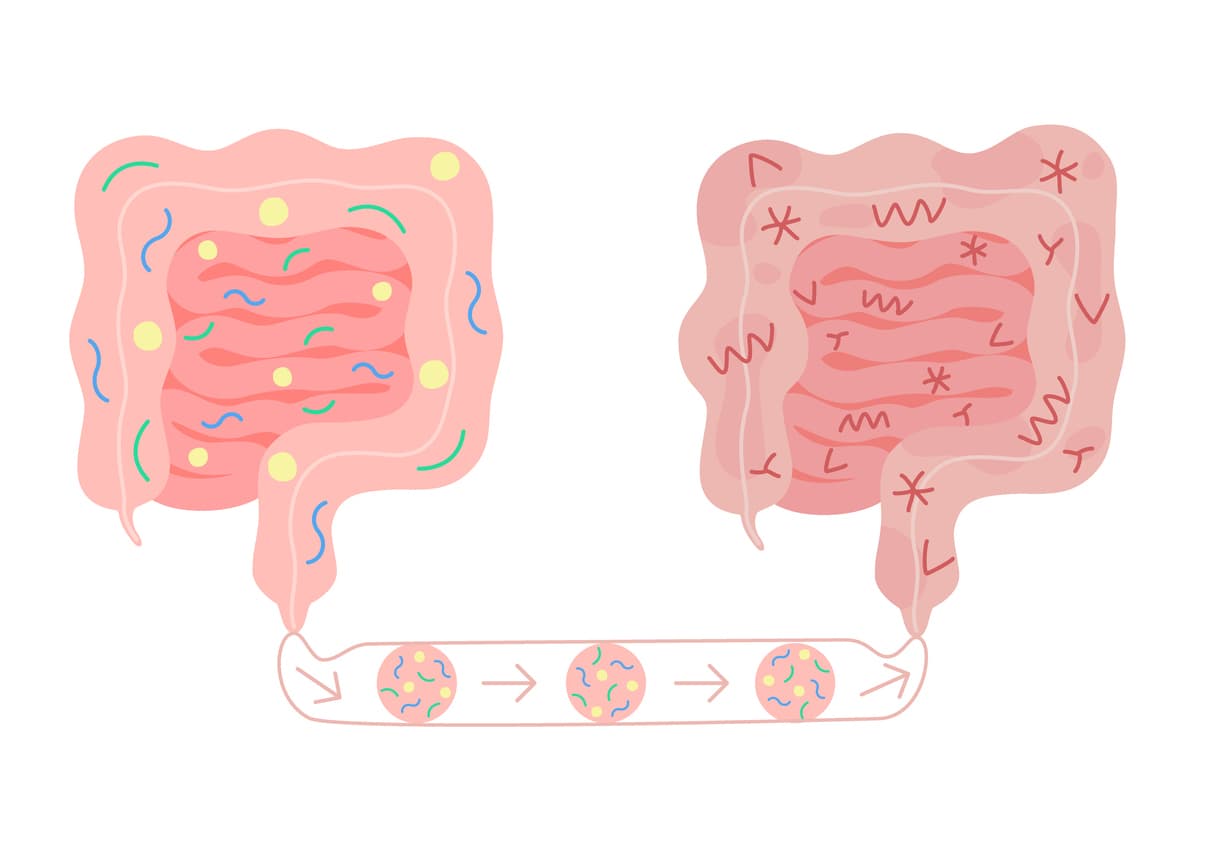

- No underwriting is required to change into Medicare Advantage. However, if you want to switch to a Medigap Plan, you need to go through underwriting if you don’t switch within your first year of eligibility.

- Drug Plan (Part D) is included.

- Medicare Advantage plans are often referred to as the Pay As You Go option. You will still have your Part B premium from Original Medicare; you will receive the same coverage as Original Medicare with some potential added benefits of vision, dental, and other services.

Door 3 - Medigap (also known as Medicare Supplement)

- You pay an additional monthly premium, but you don’t have any out-of-pocket costs on many plans. For this article, we’ll consider the most common Medicare Supplement: Plan G.

- You can visit any provider or hospital that accepts Medicare.

- In many cases, no underwriting is required to sign up. However, as mentioned earlier, you might need to go through underwriting if you are switching into this plan. We’ll talk through an example later about how this might play out, but what’s important to know is that it’s harder to join this plan later.

- Drug Plan (Part D) and other ancillary benefits are purchased separately.

The Common Catastrophe

Door 1 - Original Medicare

- This person thought they didn’t need to consider other forms of coverage since they were totally healthy. Maybe they had planned to spend more on healthcare and get better coverage as they entered their 70s or 80s, but they did not anticipate needing this much coverage so suddenly.

- Instead, they’re trying to make it through winter with only

a hat and gloves

. - Immediately after their fall, they are admitted as an inpatient to the emergency room; they pay the $1,600 deductible.

- This might seem like a manageable cost given the severity of a broken hip, but think of all of the potential complications of such a significant injury.

- They have surgery, physical therapy, nerve blocks for pain, and more. They would have to pay 20% coinsurance for all of the costs outside of the inpatient hospital admission.

- After a few months, they elect to get hip replacement surgery. That’s another deductible of $1,556 since the benefit period is reset after 60 days from the first accident. Plus the 20% coinsurance of all the rehab and pain associated costs again. You can see how these costs will pile up. And with only Original Medicare, there is no Out-of-Pocket maximum to protect them.

From a 2018 study, the average cost of receiving treatment for a hip fracture is $40,000

. They might be on the hook for at least 20% of that.

- How much does this cost over 2 years?

- Part A - $1,600 deductible + $1,600 deductible = $3,200

- Part B -

- $226 deductible ($226 in 2023) × 2 = $452

- $164.90 premium × 24 = $3,957.60

- 20% of $40,000 = $8,000

- Total = $15,609.60

Door 2 - Medicare Advantage

- This gives them more coverage than just Original Medicare, but they might still be leaving themselves exposed.

- Let’s say they picked an HMO plan because that was the cheapest option, and their PCP was in-network.

- If they set up their Medicare Advantage plan in Florida, but break their hip in New York, all non-emergency services (like physical therapy, a follow up with the orthopedic surgeon, even the person reading the X-Ray results to the patient) will be out-of-network and not covered. They could still get in network coverage, but it would likely require getting on a plane with a recently surgically repaired hip. Sounds unpleasant.

- If they wanted one specific doctor to fix their hip who happened to be out-of-network, they might have to pay the total cost out-of-pocket.

- A PPO plan gives them more flexibility to see someone out of their network if they are traveling. They will have their hard cap on spending with the yearly Out-of-Pocket Maximum, which will depend on their choice of plan.

- How much does this cost over 2 years?

- Monthly Premium of $164.90 × 24 = $3,957.60

- A realistic scenario with an ambulance ($300), 5 day hospital stay ($300 per day for first week), weekly physical therapy ($10 copayment), monthly specialist visits ($35 copayment), and monthly primary care visits ($10 copayment) will have them spending ($300 + $1500) + (104 × $10) + (24 × $25) + (24 × $10)

- Total = $1800 + $1,040 + $840 + $240 = $3,920 + $3,957.60 = $7,877.60

- A worst-case scenario will see them hit Max. Out-of-Pocket Cost of $5,500 per year × 2 = $11,000

- Total = $14,957.60

Door 3 - Medigap (Specifically, Plan G)

- They picked the plan with the higher monthly premiums, but it might save them money in the long run by avoiding out-of-pocket costs.

- Because they signed up for Medigap during their first window of eligibility, they didn’t have to go through Medical Underwriting which could deny them coverage or raise their premium.

- Medigap is the option that might cost the most on a monthly basis, but might also give them the most flexibility moving forward.

- They can see any doctor that accepts Medicare, there are no networks to fuss over.

- They have minimal or no out-of-pocket costs except monthly premiums.

- Since they signed up for Plan G, they are also covered against Excess Charges, which can be up to 15% above what Medicare allows for a service.

- How much does this cost over 2 years?

- Monthly Premium ($164.90 + $115) × 24 = $6,717.60

- Annual Part B Deductible of $226 × 2 = $452

- Total: $7,169.60

Making Your First Call the Right Call

Seeking Care Outside Your Network

Here’s a tool from the CMS to research which providers have opted-out of Medicare

.Right Place, Right Time

- For Part B, 10% of your premium for each year you’re without coverage.

- For Part D, 1% of your premium for each month you’re without coverage.

Conclusion

- Your plan should fit your budget, risk preference, coverage needs, and your lifestyle.

- Evaluate if you should stick with the plan you are currently committed to, or if you can switch to a potentially better fit plan.

- You can switch plans annually, but your first choice of Medicare plan is crucial as it can close some doors.

Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

20 Questions to Ask Your Medicare Agent

2023 Medicare Annual Election Period (AEP)

Are Medicare Advantage Plans Bad?

Building the Future of Senior Healthcare

Can I Choose Marketplace Coverage Instead of Medicare?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Can Medicare Help with the Cost of Tyrvaya?

Do All Hospitals Accept Medicare Advantage Plans?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Jakafi?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Ozempic?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Stair Lifts?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Zilretta?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Does Medicare Pay for Varicose Vein Treatment?

Estimating Prescription Drug Costs

Explaining IRMAA on Medicare

Explaining the Different Enrollment Periods for Medicare

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

Finding the Best Vision Plans for Seniors

How Do Medigap Premiums Vary?

How Does Medicare Pay for Emergency Room Visits?

How is Medicare Changing in 2023?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Cost?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How to Become a Medicare Agent

How to Choose a Medigap Plan

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Botox Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is Gainswave Covered by Medicare?

Is HIFU Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Consulting Services

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medicare Supplement Plans for Low-Income Seniors

Medigap vs. Medicare Advantage

The Fair Square Bulletin: The End of the COVID Emergency Declaration

Welcome to Fair Square's First Newsletter

What Is a Medicare Advantage POS Plan?

What Is Medical Underwriting for Medigap?

What People Don't Realize About Medicare

What to Do When Your Doctor Doesn't Take Medicare

What You Need to Know About Creditable Coverage

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M