Paying more than you expected? Let's talk it through

Stay Up to Date on Medicare!

Introducing IRMAA and its purpose

Who is affected by IRMAA and how is it calculated?

How is IRMAA applied?

How does the Social Security Administration determine if someone needs to pay an additional premium for Medicare Part B or Part D coverage?

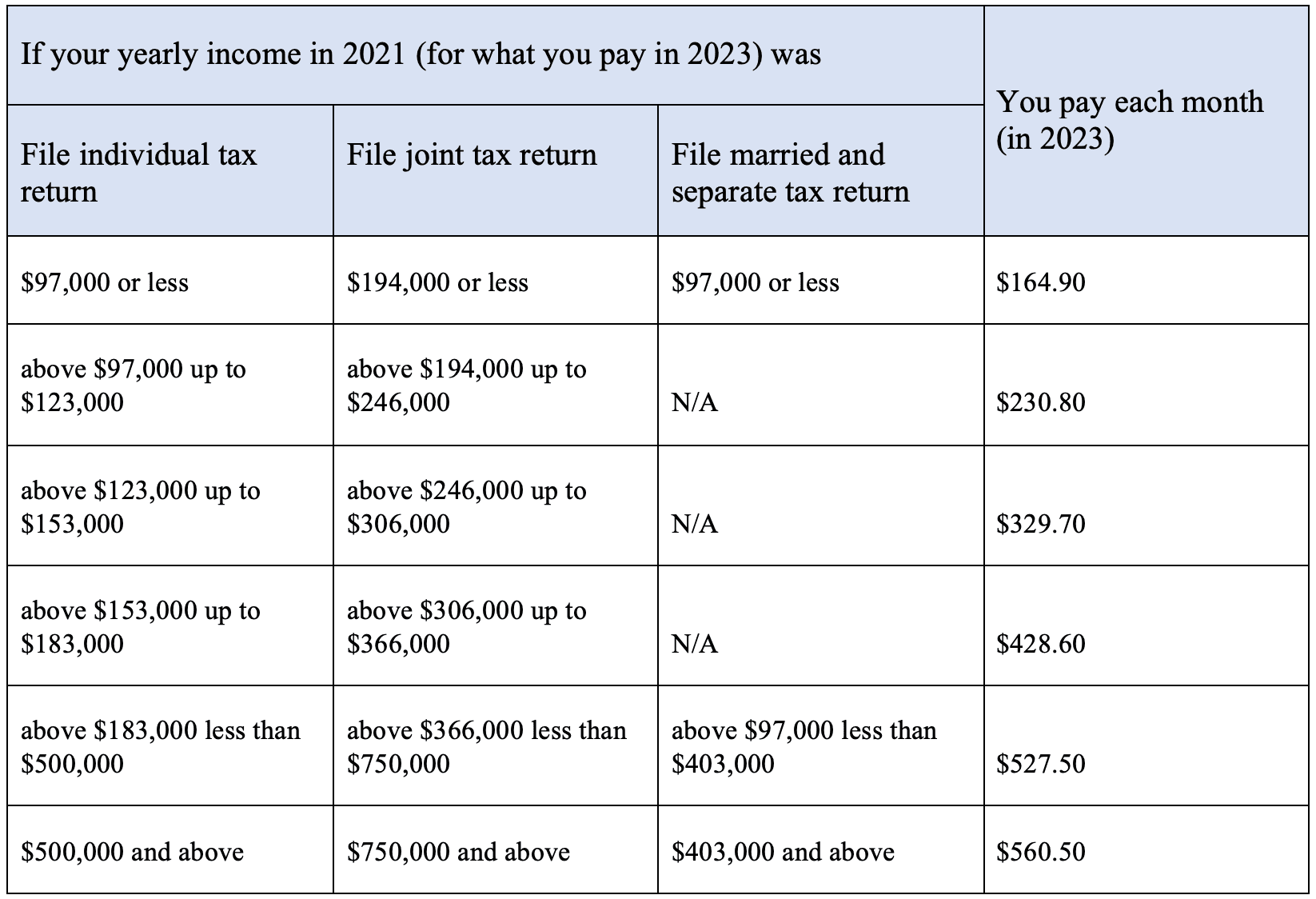

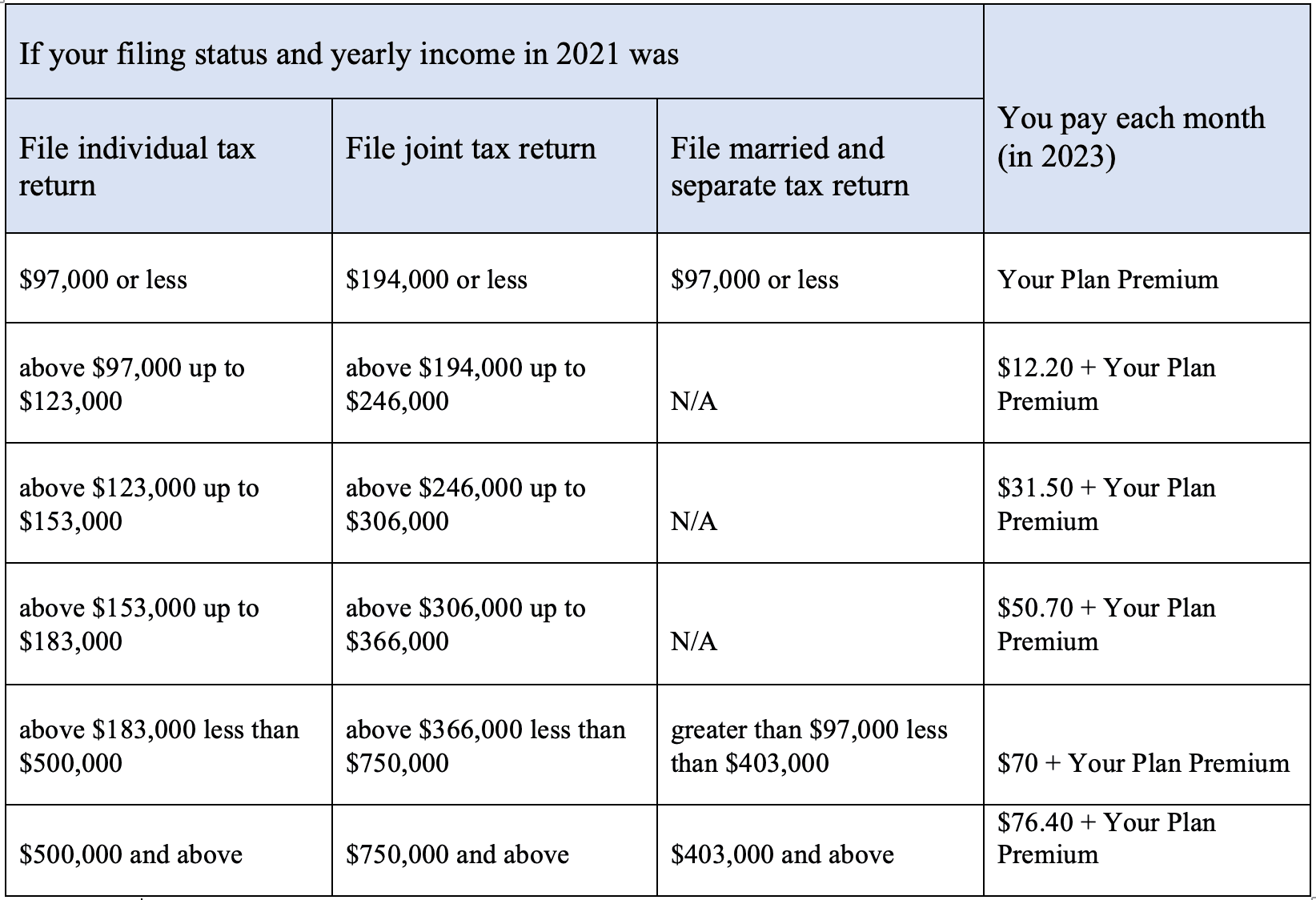

What are the income thresholds that trigger IRMAA payments?

How can beneficiaries appeal their IRMAA determination?

Medicare website

.Tips on reducing your Medicare premiums with IRMAA in mind

Questions to ask when considering a Medicare plan with higher premiums due to IRMAA

- What additional coverage or services does this plan offer that would be beneficial?

- Will my out-of-pocket costs be lower if I switch to this plan?

- Are there any additional costs associated with the plan that I should be aware of?

- Is it possible to switch plans if I decide this one is not right for me?

Conclusion

Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Seattle

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Have Two Primary Care Physicians?

Can I Laminate My Medicare Card?

Can Medicare Help with the Cost of Tyrvaya?

Comparing All Medigap Plans | Chart Updated for 2023

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Cosmetic Surgery?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Flu Shots?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Mental Health?

Does Medicare Cover Nuedexta?

Does Medicare Cover Ofev?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover PTNS?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Service Animals?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Vitamins?

Does Medicare Cover Wart Removal?

Does Medicare Pay for Bunion Surgery?

Does Medicare Require a Referral for Audiology Exams?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Estimating Prescription Drug Costs

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Fair Square Client Newsletter: AEP Edition

Health Savings Accounts (HSAs) and Medicare

How Do Medicare Agents Get Paid?

How Much Does Medicare Cost?

How Much Does Medicare Part B Cost in 2023?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Enroll in Social Security

Is Balloon Sinuplasty Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is Gainswave Covered by Medicare?

Is HIFU Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medicare Savings Programs in Kansas

Medigap vs. Medicare Advantage

Plan G vs. Plan N

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

The Fair Square Bulletin: June 2023

The Fair Square Bulletin: October 2023

The Fair Square Bulletin: September 2023

The Fair Square Bulletin: The End of the COVID Emergency Declaration

Top 10 Physical Therapy Clinics in San Diego

What Is Medical Underwriting for Medigap?

What People Don't Realize About Medicare

Why You Should Keep Your Medigap Plan

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M