Making Sense Out of the Medigap Alphabet Soup

Stay Up to Date on Medicare!

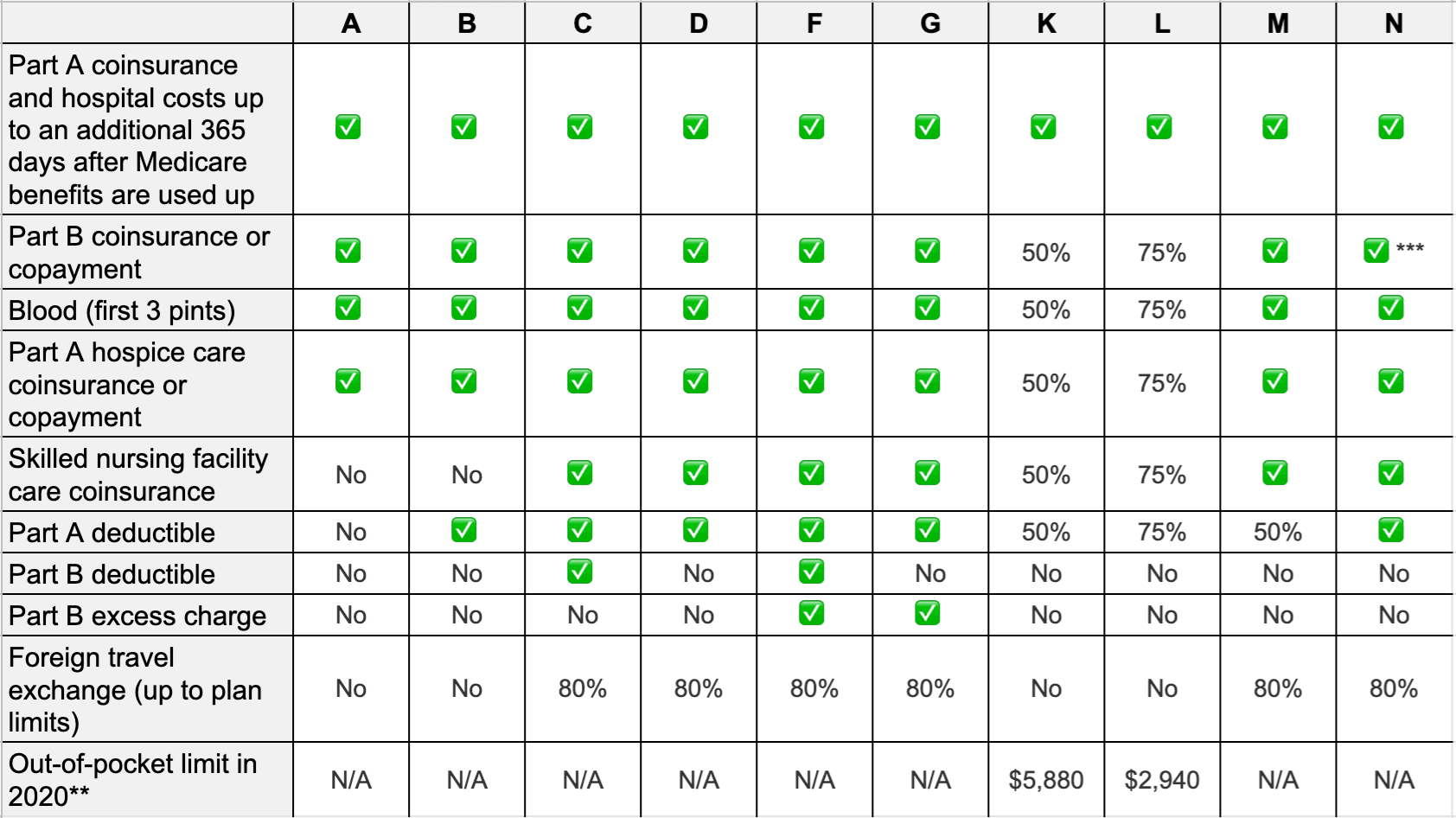

- Coverage for Part A Coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up - With just Part A, you have to pay $400 per day in 2023 or more after the 61st day you're in the hospital. Plan G covers this and gives you an extra year of covered days.

- Part B Coinsurance - With Part B, you're on the hook for 20% of medical expenses after you meet your deductible. Plan G covers all qualifying medical expenses after you meet your deductible.

- Blood - Should you need blood, Plan G covers the first three pints, which Part A does not.

- Part A Hospice & Skilled Nursing Facility Care - Should you go to a hospice or skilled nursing facility, Plan G covers your coinsurance.

- Part A deductible - Plan G covers your Part A deductible, $1,600 in 2023.

- Part B deductible - Plan G does not cover this.

- Part B Excess Charge - Doctors who accept Medicare will sometimes bill more than what Medicare will reimburse. Usually, you are on the hook for this "excess charge" but Plan G will cover it.

- Foreign Travel - Plan G will pay for 80% of your medical expenses abroad up to $50,000.

- Out of Pocket Limit - There is no out-of-pocket limit

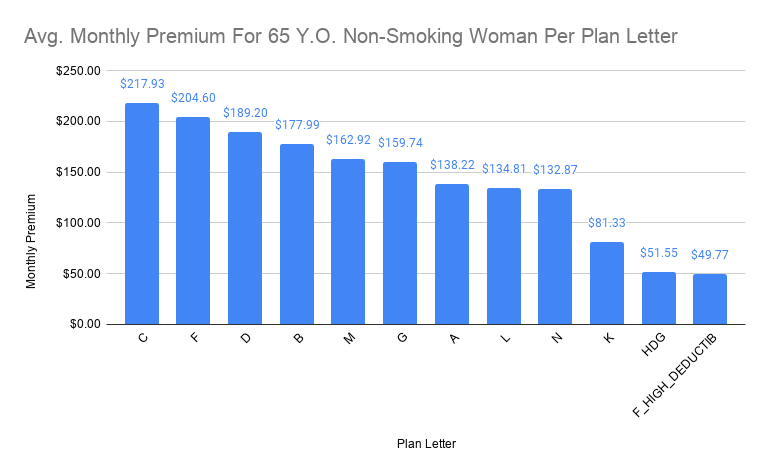

- Five plans are more expensive than Plan G, but only one, Plan F, has stronger benefits. This lets us rule out Plans C, D, B, and M. No point in paying more for less coverage.

- The only difference between Plan F and G is that the former covers the $226 Medicare Part B deductible. However, looking closely at the chart we see that Plan F costs, on average, about $50 more per month than Plan G. No point in paying an extra $600 a year for $226 in savings.

www.fairsquaremedicare.com

to see how much you'd pay for Plan G.Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

20 Questions to Ask Your Medicare Agent

2023 Medicare Annual Election Period (AEP)

2024 Medicare Price Changes

Can Doctors Choose Not to Accept Medicare?

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans be Used Out of State?

Do I Need Medicare If My Spouse Has Insurance?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Home Heart Monitors?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inqovi?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Ozempic?

Does Medicare Cover Qutenza?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Vitamins?

Does Medicare Cover Zilretta?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Funeral Expenses?

Does Medicare Require a Referral for Audiology Exams?

Does Your Plan Include A Free Gym Membership?

Explaining IRMAA on Medicare

Fair Square Client Newsletter: AEP Edition

How Are Medicare Star Ratings Determined?

How Does Medicare Pay for Emergency Room Visits?

How is Medicare Changing in 2023?

How Much Does Rexulti Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Become a Medicare Agent

How to Choose a Medigap Plan

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is HIFU Covered by Medicare?

Medicare Advantage Plans for Disabled People Under 65

Medicare Supplement Plans for Low-Income Seniors

Medigap vs. Medicare Advantage

The Easiest Call You'll Ever Make

The Fair Square Bulletin: July 2023

The Fair Square Bulletin: September 2023

What Happens to Unused Medicare Set-Aside Funds?

What If I Don't Like My Plan?

What Is Medical Underwriting for Medigap?

What is the Medicare ICEP?

What People Don't Realize About Medicare

What You Need to Know About Creditable Coverage

Which Medigap Policies Provide Coverage for Long-Term Care?

Will Medicare Cover Dental Implants?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M