Medicare in 2023: What You Need to Know

Stay Up to Date on Medicare!

Medicare

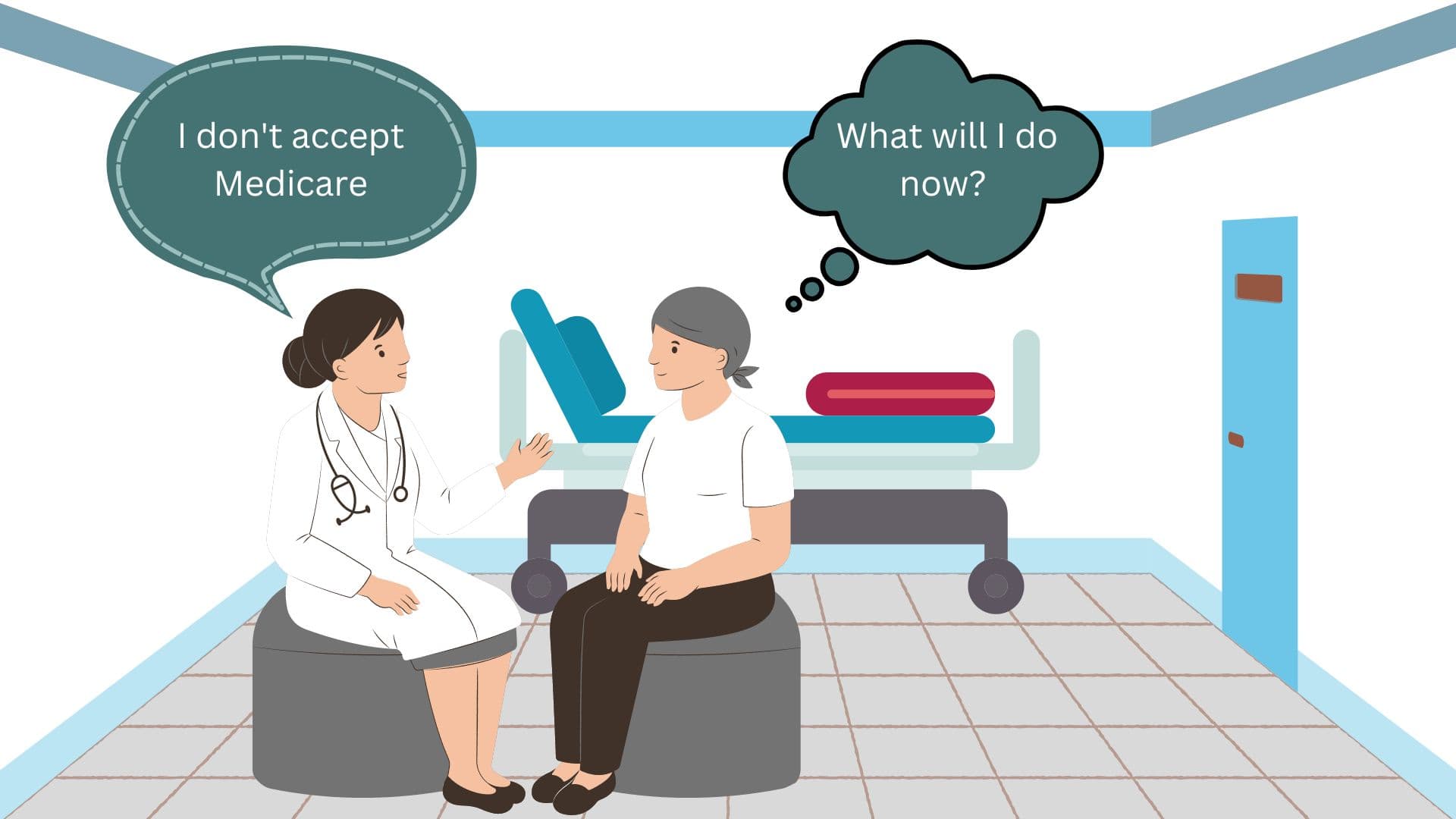

, beneficiaries may need to pay premiums for certain parts of the program, along with deductibles, copays and coinsurance for most services.online tool

can explain the various plan options you have along with their costs.What's the Cost of Medicare Part A in 2023?

benefit period

.- Days 1-60: $0

- Days 61-90: $400 per day

- Days 91-150: $800 per day while using your 60

lifetime reserve days

. - After 150 days: All costs

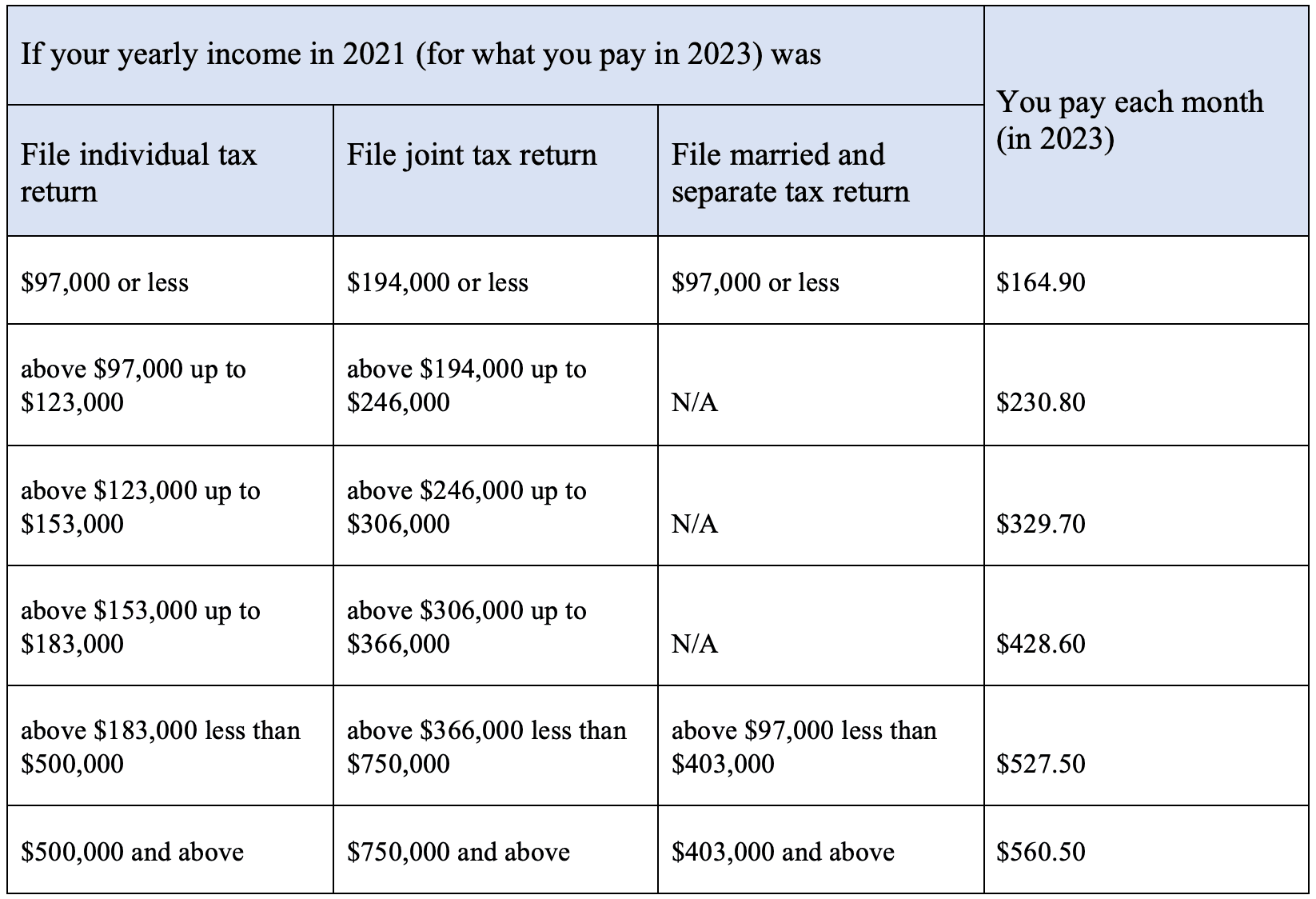

How Much Does Medicare Part B Cost in 2023?

MAGI

(modified adjusted gross income).IRMAA

).

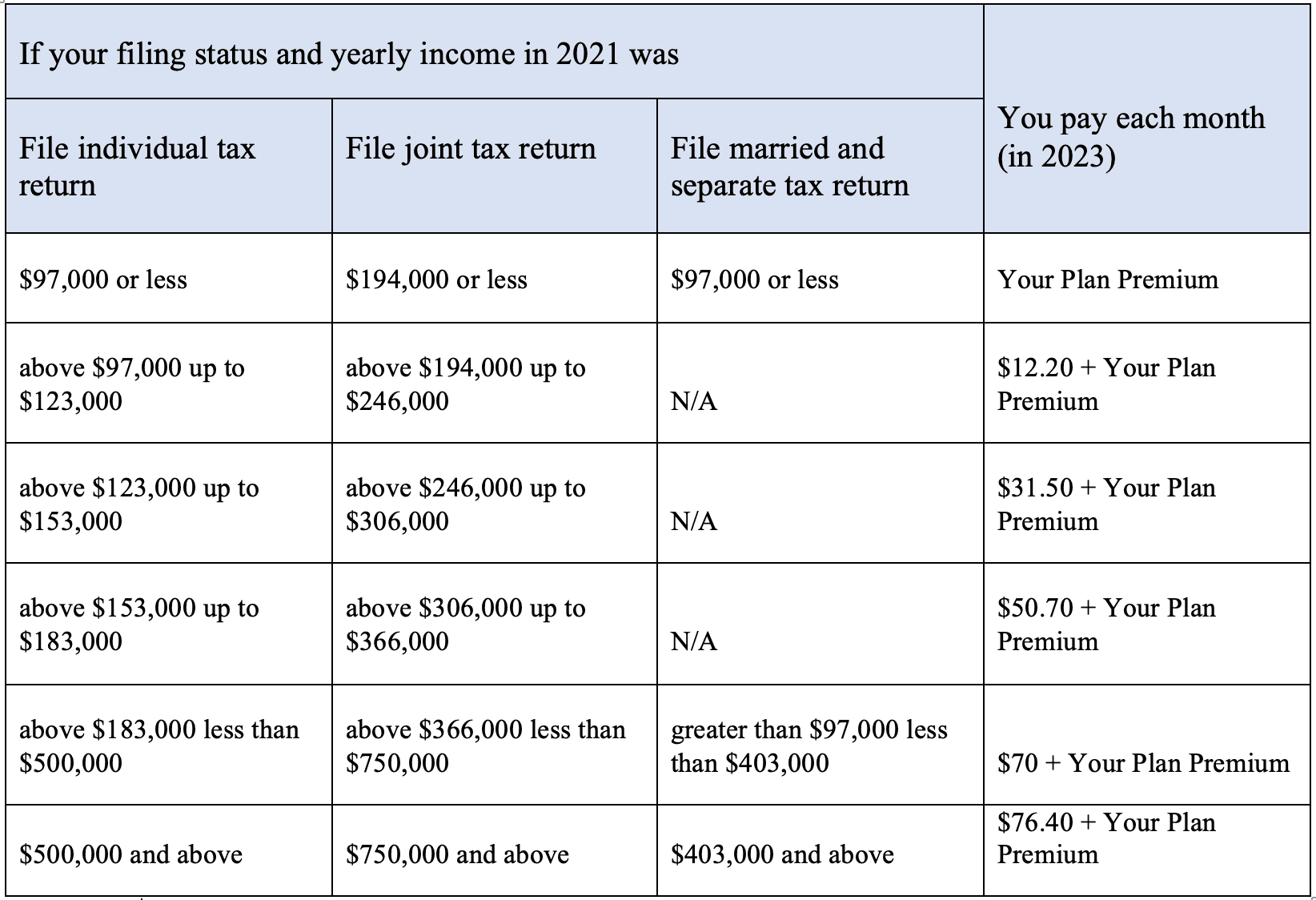

How Much Does Medicare Part D (Drug Coverage) Cost in 2023?

How Much Will a Medicare Advantage Plan (Part C) Cost?

Medicare Advantage Plans

, sometimes called "Part C" or "MA Plans," are offered by private insurance companies approved by Medicare.cost of different Medicare Advantage Plans

in your area before deciding the plan you want to choose.How Much Will a Medicare Supplement Plan Cost?

Medigap

) helps cover your Part A and Part B deductibles and copays.cost of Medigap

depends on the individual plan, where you live, and other factors. However, you still need to pay your Medicare Part B premium. On average, a Medigap could cost you $163/month.What's a Late Enrollment Penalty?

Conclusion

Fair Square Medicare

helps you understand the gamut of Medicare plans and their costs. Our licensed experts can estimate how much Medicare will cost you so that you can plan ahead. Call us at 1-888-376-2028 for any Medicare-related questions. We're always here to help!Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

20 Questions to Ask Your Medicare Agent

2023 Medicare Annual Election Period (AEP)

2024 "Donut Hole" Updates

Can I Change My Primary Care Provider with an Advantage Plan?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Costco Pharmacy Partners with Fair Square

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover COVID Tests?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare Cover Home Heart Monitors?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Ilumya?

Does Medicare Cover INR Machines?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Nuedexta?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Tymlos?

Does Medicare Cover Wart Removal?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Bunion Surgery?

Does Medicare Pay for Varicose Vein Treatment?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Dental Plans for Seniors

How Do Medigap Premiums Vary?

How Does Medicare Pay for Emergency Room Visits?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Cost?

How Much Does Trelegy Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Become a Medicare Agent

How to Choose a Medigap Plan

Is Balloon Sinuplasty Covered by Medicare?

Is Gainswave Covered by Medicare?

Is HIFU Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare 101

Medicare Advantage MSA Plans

Medicare Consulting Services

Medigap vs. Medicare Advantage

Seeing the Value in Fair Square

The Fair Square Bulletin: June 2023

The Fair Square Bulletin: The End of the COVID Emergency Declaration

What If I Don't Like My Plan?

What is a Medicare Beneficiary Ombudsman?

What Is Medical Underwriting for Medigap?

What is the Medicare ICEP?

What You Need to Know About Creditable Coverage

Why Is Medicare So Confusing?

Will Medicare Cover Dental Implants?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M