Medicare drug plans usually cover Ozempic, but it may depend on your specific plan.

Stay Up to Date on Medicare!

Medicare

prescription drug plans cover Ozempic.What’s Ozempic?

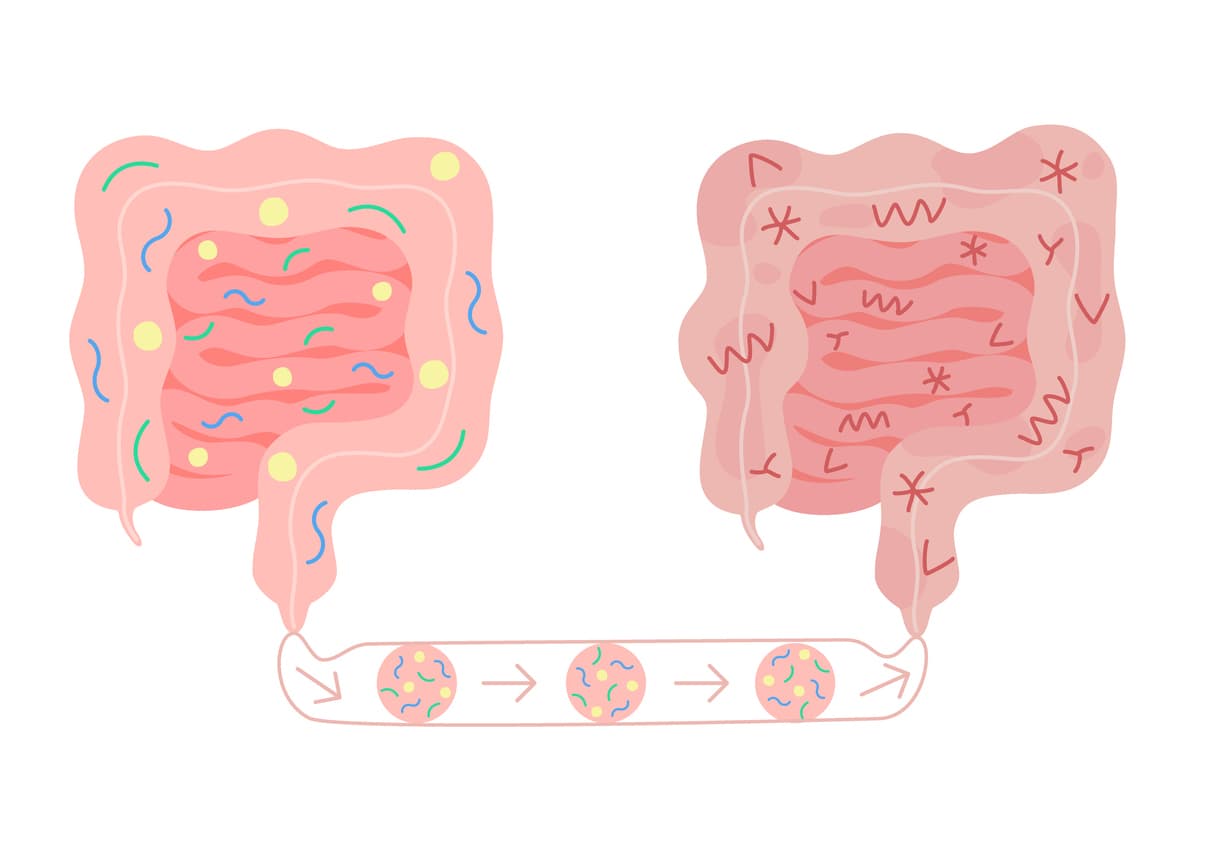

hormone GLP-1

, which helps regulate blood sugar levels in your body. When taken in conjunction with a healthy diet and regular exercise, Ozempic can reduce blood sugar levels and lower the risk of heart attack,stroke

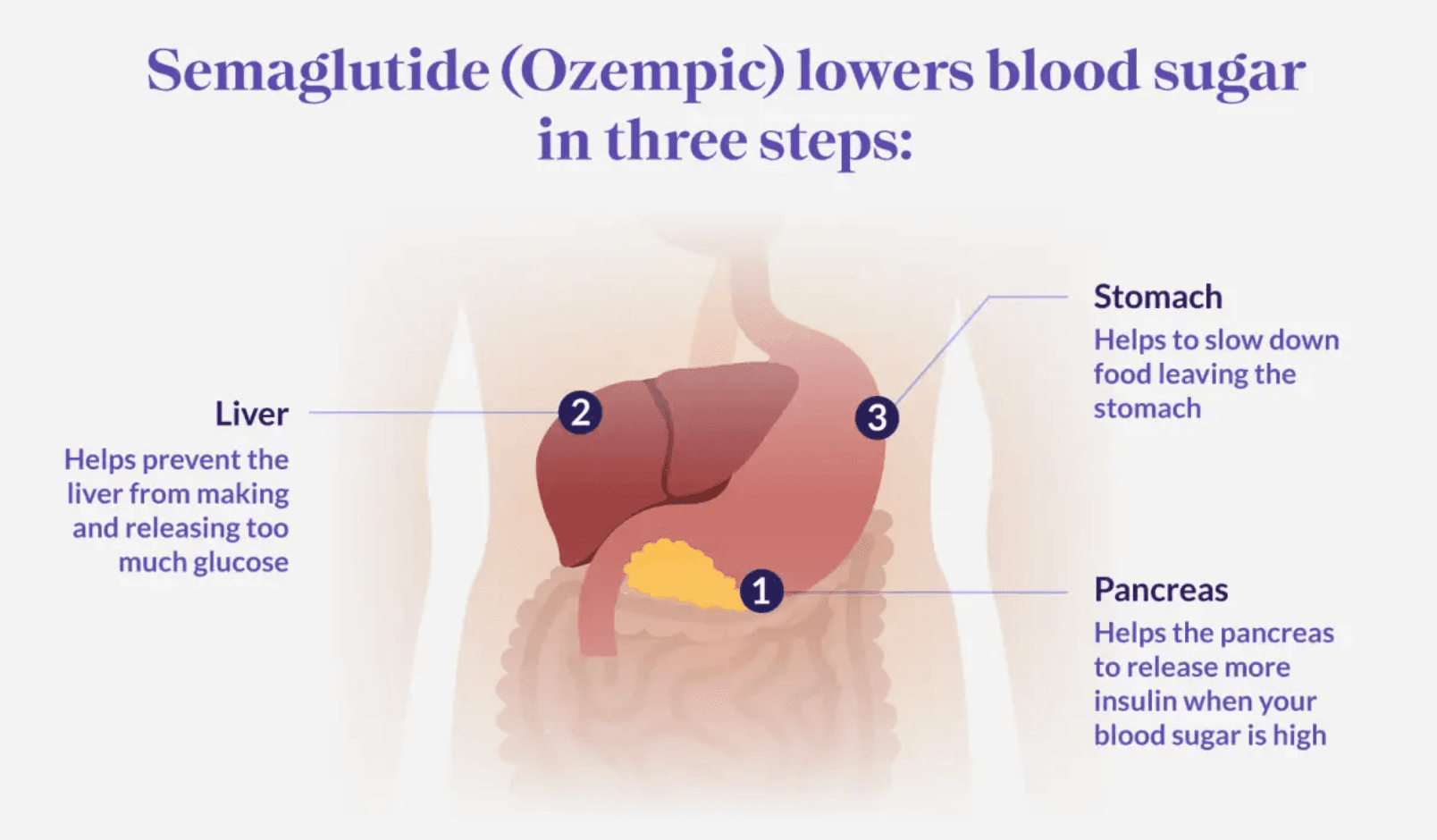

, or death in adults with type 2 diabetes.How Does Ozempic Work?

- Stimulating the pancreas to release more insulin in response to high blood glucose levels.

- Inhibiting the liver from producing and releasing excessive glucose into the bloodstream.

- Reducing the rate at which food empties from the stomach after a meal.

Does Medicare Cover Ozempic?

- Medicare Part D — Most Medicare Part D plans cover Ozempic. Check your plan's formulary or ask your insurance provider to confirm your coverage

- Medicare Advantage Plan — If you're enrolled in a

Medicare Advantage Plan

that includes prescription drugs and Ozempic is included in your plan's formulary, then you might get coverage for the medication - Medicare Part B — If you receive Ozempic in a doctor's office or at a skilled nursing facility, your

Medicare Part B

may provide coverage for the medication - Medicare Part A — If you receive Ozempic while you're admitted to a hospital or a skilled nursing facility,

Medicare Part A

may cover the cost of the medication

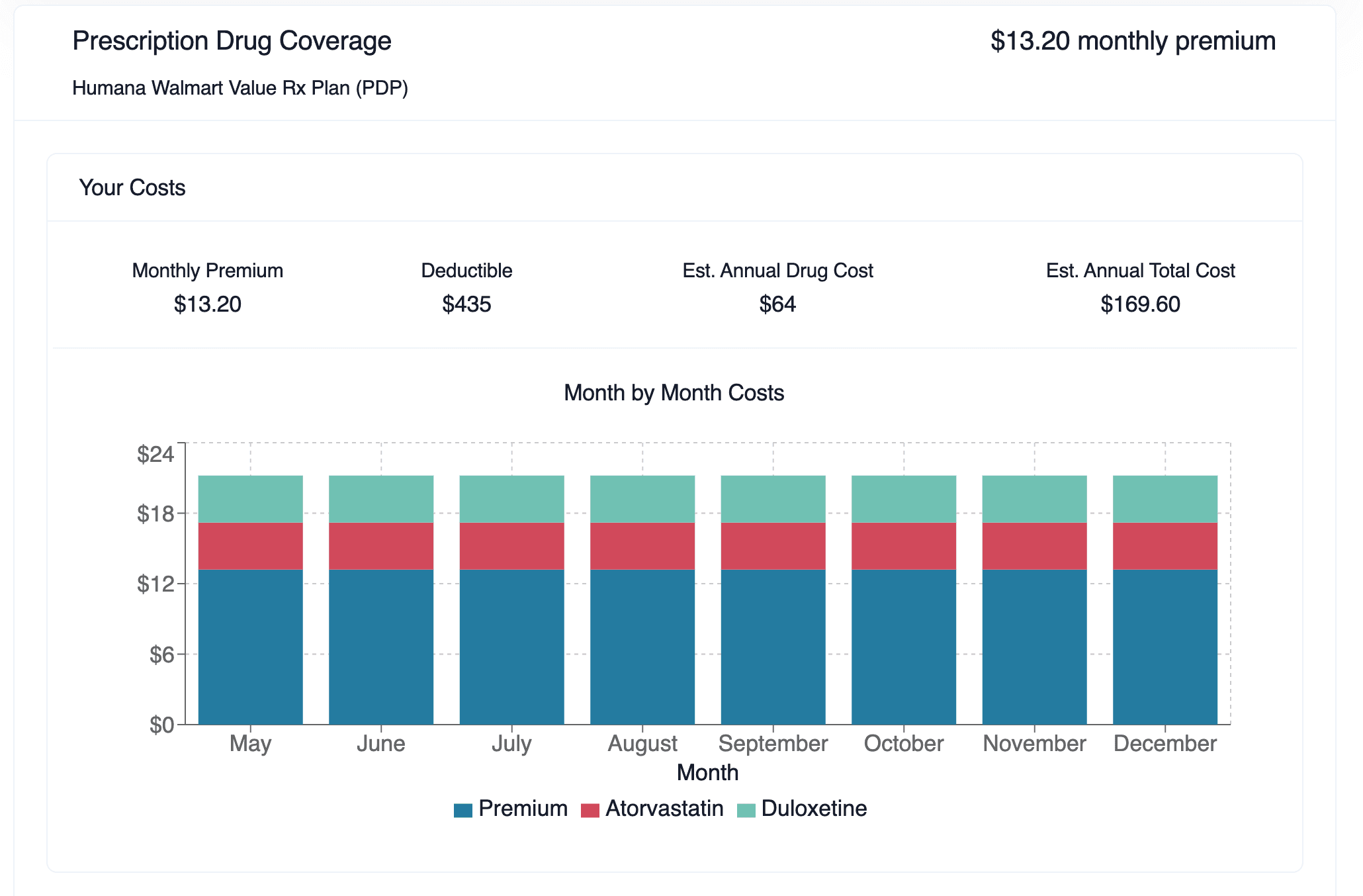

How Much Does Ozempic Cost?

prescription drug

plan, the cost of Ozempic will vary based on the coverage stage you’re currently in. Here's an outline of the various costs:1. Deductible Stage

2. Post-Deductible Stage

3. Coverage Gap

Donut Hole

), Medicare has a temporary limit on what it will cover for your medication, which may result in you paying more for your prescription.4. Catastrophic Coverage

Can I Get Financial Assistance to Pay for Ozempic?

Use a Coupon

GoodRx

andSingleCare

offer free and discounted coupons for several medications.The Novo Nordisk Patient Assistance Program

Patient Assistance Program

is designed to provide medications at no cost to eligible patients who do not have Medicare or any other insurance.A Savings Card

eligible

for the Ozempic Savings Card provided by Novo Nordisk. This card offers a maximum savings of up to $150 per month or $450 for a three-month supply and is valid for two years.Medicare Extra Help

Medicare Extra Help

program, also known as the Part D Low-Income Subsidy. This federal subsidy aids Medicare beneficiaries in covering out-of-pocket expenses related to their Medicare prescription drug plan. If you'reeligible

, this program will cover your Part D premiums, deductibles, and copayments.Bulk Order

Compare Costs

Alternate Medication

Plan Wisely for the Best Coverage

Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

20 Questions to Ask Your Medicare Agent

2023 Medicare Annual Election Period (AEP)

2024 "Donut Hole" Updates

Are Medicare Advantage Plans Bad?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I switch From Medicare Advantage to Medigap?

Do All Hospitals Accept Medicare Advantage Plans?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Abortion Services?

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover COVID Tests?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Ilumya?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mental Health?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Ozempic?

Does Medicare Cover Qutenza?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Vitamins?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Funeral Expenses?

Does Your Medicare Plan Cover B12 Shots?

Explaining the Different Enrollment Periods for Medicare

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Cover Colonoscopies?

How is Medicare Changing in 2023?

How Medicare Costs Can Pile Up

How Much Does Medicare Cost?

How Much Does Medicare Part B Cost in 2023?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Balloon Sinuplasty Covered by Medicare?

Is Fair Square Medicare Legitimate?

Medigap vs. Medicare Advantage

The Fair Square Bulletin: August 2023

The Fair Square Bulletin: July 2023

The Fair Square Bulletin: June 2023

The Fair Square Bulletin: The End of the COVID Emergency Declaration

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What If I Don't Like My Plan?

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What People Don't Realize About Medicare

What to Do When Your Doctor Doesn't Take Medicare

When Can You Change Medicare Supplement Plans?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M