Some tips to avoid missing out on your ideal Medigap plan

Stay Up to Date on Medicare!

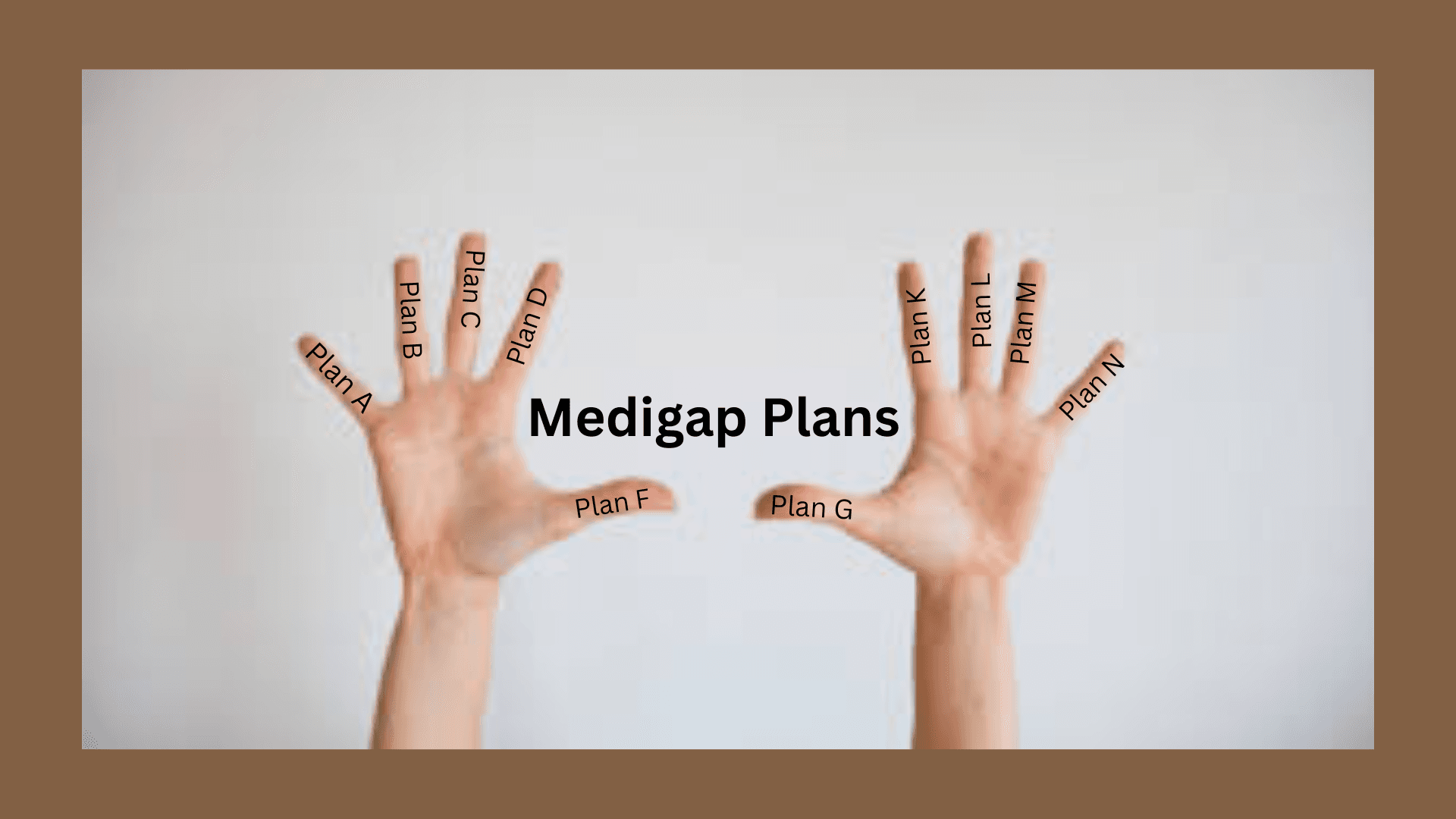

choosing the right Medigap plan for your needs

. In this article, we'll delve deeper into the topic of medical underwriting for Medigap and explain its purpose, how it works, and why it's necessary for both insurance companies and policyholders.What is Medical Underwriting for Medigap?

special enrollment period

or you are in a state with a birthday rule, then you can enroll without facing scrutiny regarding your pre-existing conditions.How Does Medical Underwriting for Medigap Work?

the open enrollment period

, which is a six-month window that starts the month an individual turns 65 and enrolls in Medicare Part B. During this period, insurance companies are required to offer Medigap coverage to anyone, regardless of their health status.Why is Medical Underwriting Necessary for Medigap?

How Beneficiaries Can Avoid Underwriting

Conclusion

Fair Square

at 888-376-2028. Our licensed Medicare agents can help you navigate the process and find the right plan for you.Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Washington, D.C.

14 Best Ways to Stay Active in Charlotte

15 Best Ways for Seniors to Stay Active in Denver

2024 "Donut Hole" Updates

2024 Medicare Price Changes

Building the Future of Senior Healthcare

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Have Two Primary Care Physicians?

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover Boniva?

Does Medicare Cover Cala Trio?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Nexavar?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover PTNS?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Wart Removal?

Does Medicare Pay for Bunion Surgery?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Does Medicare Pay for Varicose Vein Treatment?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Fair Square Bulletin: We're Revolutionizing Medicare

Health Savings Accounts (HSAs) and Medicare

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Pay for Emergency Room Visits?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2023?

How Medicare Costs Can Pile Up

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Cost?

How Much Does Medicare Part B Cost in 2023?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Enroll in Social Security

Is Balloon Sinuplasty Covered by Medicare?

Is PAE Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medicare Guaranteed Issue Rights by State

Should You Work With A Remote Medicare Agent?

The Fair Square Bulletin: June 2023

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What Is a Medicare Advantage POS Plan?

What Is Medical Underwriting for Medigap?

What is the 8-Minute Rule on Medicare?

When Can You Change Medicare Supplement Plans?

Why You Should Keep Your Medigap Plan

Will Medicare Cover Dental Implants?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M