The Pros and Cons of Medicare Advantage Plans

Stay Up to Date on Medicare!

Are Medicare Advantage Plans truly bad?

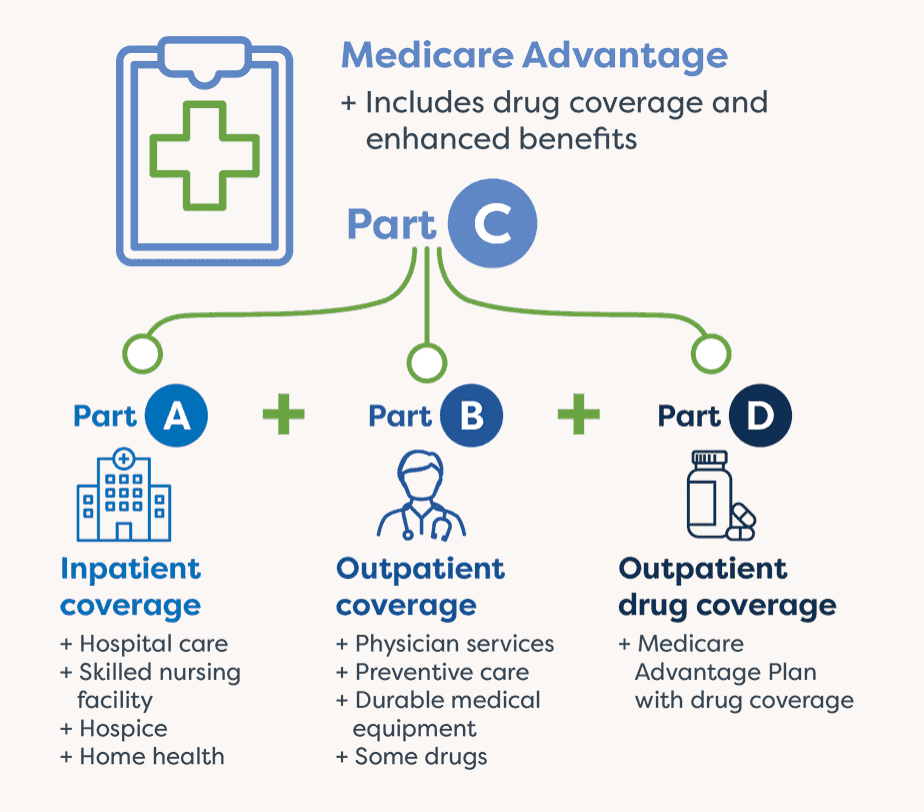

What's a Medicare Advantage Plan?

Medicare Part C

. These plans are offered by private insurance companies (mostly insurance companies regulated by the state) and are authorized by the federal government to offer benefits on top of Parts A and B.

Medicare Advantage | Source: NascentiaHealth

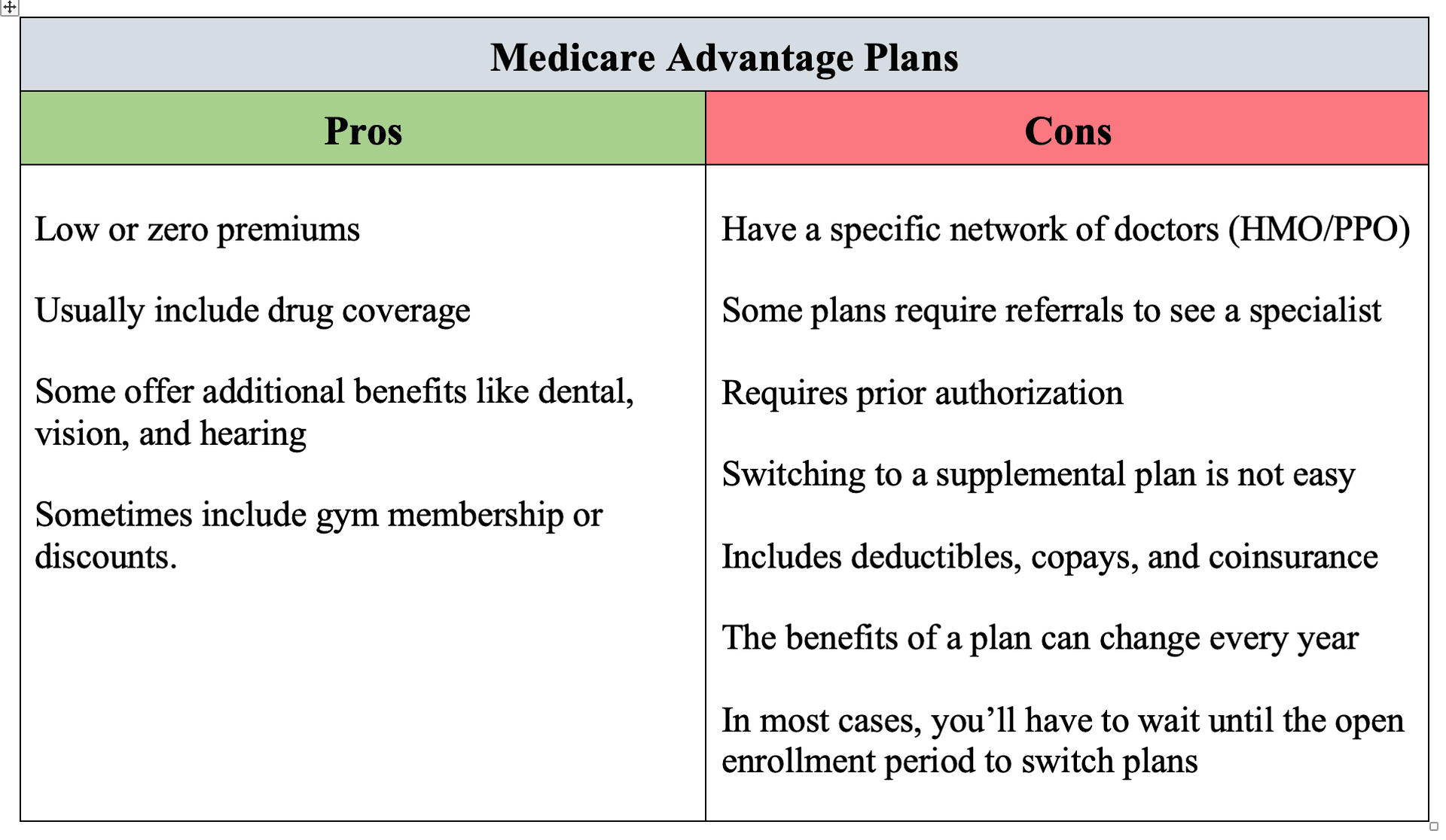

Pros and Cons of Medicare Advantage Plans

Pros and Cons of Medicare Advantage Plans

The Pros of Medicare Advantage

Many Plans have Low Monthly Premiums

Plans Usually Include Drug Coverage

It Typically Offers Additional Benefits Like Dental, Vision, and Hearing

Plans Sometimes Include Free or Discounted Gym Memberships (in Addition to Other Potential Benefits!)

The Cons of Medicare Advantage

It Has a Limited Network of Doctors (HMO/PPO)

In Most Cases, You May Only Switch Plans During Open Enrollment

You May Need a Referral to See a Specialist

Prior Authorization can Affect Coverage

Switching to a Medicare Supplement Plan Is Not Easy

medical underwriting

. So, you should be approved for coverage (afterenrolling in Parts A & B

) even if you have a pre-existing condition. However, if you want to switch to a Medicare Supplement, you'll usually need to undergo medical underwriting to qualify. This can be a problem if you have a pre-existing condition.initial enrollment period

is typically the only period where you can enroll in a Supplement without being denied for pre-existing conditions. It's much easier to go from Supplement -> Advantage than Advantage -> Supplement.Advantage Plans have Deductibles, Copays and Coinsurance

Advantage Plans Usually have Steep Out of Pocket Maximums

The Drug and Medical Benefits Can Change Every Year

So, is Medicare Advantage Good or Bad?

Conclusion

details

of each plan, and can end up being disappointed. A misunderstanding of the benefits offered might set your expectations incorrectly. In addition, Medicare is complex to navigate, and Medicare Advantage plans can change yearly (tacking onto beneficiaries' frustrations).Stay Up to Date on Medicare!

Recommended Articles

More of our articles

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Seattle

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

Can I Change My Primary Care Provider with an Advantage Plan?

Can Medicare Help with the Cost of Tyrvaya?

Costco Pharmacy Partners with Fair Square

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Cosmetic Surgery?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Flu Shots?

Does Medicare Cover Home Heart Monitors?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Nexavar?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Estimating Prescription Drug Costs

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Fair Square Client Newsletter: AEP Edition

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Cover Colonoscopies?

How Does Medicare Pay for Emergency Room Visits?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part B Cost in 2023?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Your Employer Insurance and Medicare Work Together

Is Balloon Sinuplasty Covered by Medicare?

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Medicare 101

Medicare Advantage Plans for Disabled People Under 65

Medicare Supplement Plans for Low-Income Seniors

Medigap vs. Medicare Advantage

Plan G vs. Plan N

Should You Work With A Remote Medicare Agent?

The Fair Square Bulletin: September 2023

Welcome to Fair Square's First Newsletter

What Is a Medicare Advantage POS Plan?

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What is the 8-Minute Rule on Medicare?

What is the Medicare ICEP?

What's the Deal with Flex Cards?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M