Read to see how Medigap plans fit with your budget

Plan G

, offer the best coverage in Medicare for many people, but this often means paying higher monthly premiums.Stay Up to Date on Medicare!

Medicaid and Medicare Savings Programs

Medicaid

is a federal and state-wide program that provides healthcare assistance to those with low-incomes. If you have both Medicare and Medicaid, Medicare pays first, and Medicaid pays second. If you qualify for Medicaid, some of the out-of-pocket costs that might be covered include:Medicare Part B

premiums.- Deductibles, coinsurance, and copayments.

Part A premiums

(for those who have to pay)- Additional prescription drugs and services that Medicare doesn't cover.

here

.link here

.- Qualified Medicare Beneficiary (QMB) program

- Specified Low-Income Medicare Beneficiary (SLMB) Program

- Qualifying Individual (QI) Program

- Qualified Disabled Working Individual (QDWI) Program

here

.Medicare Supplement Plans for Low-Income Seniors

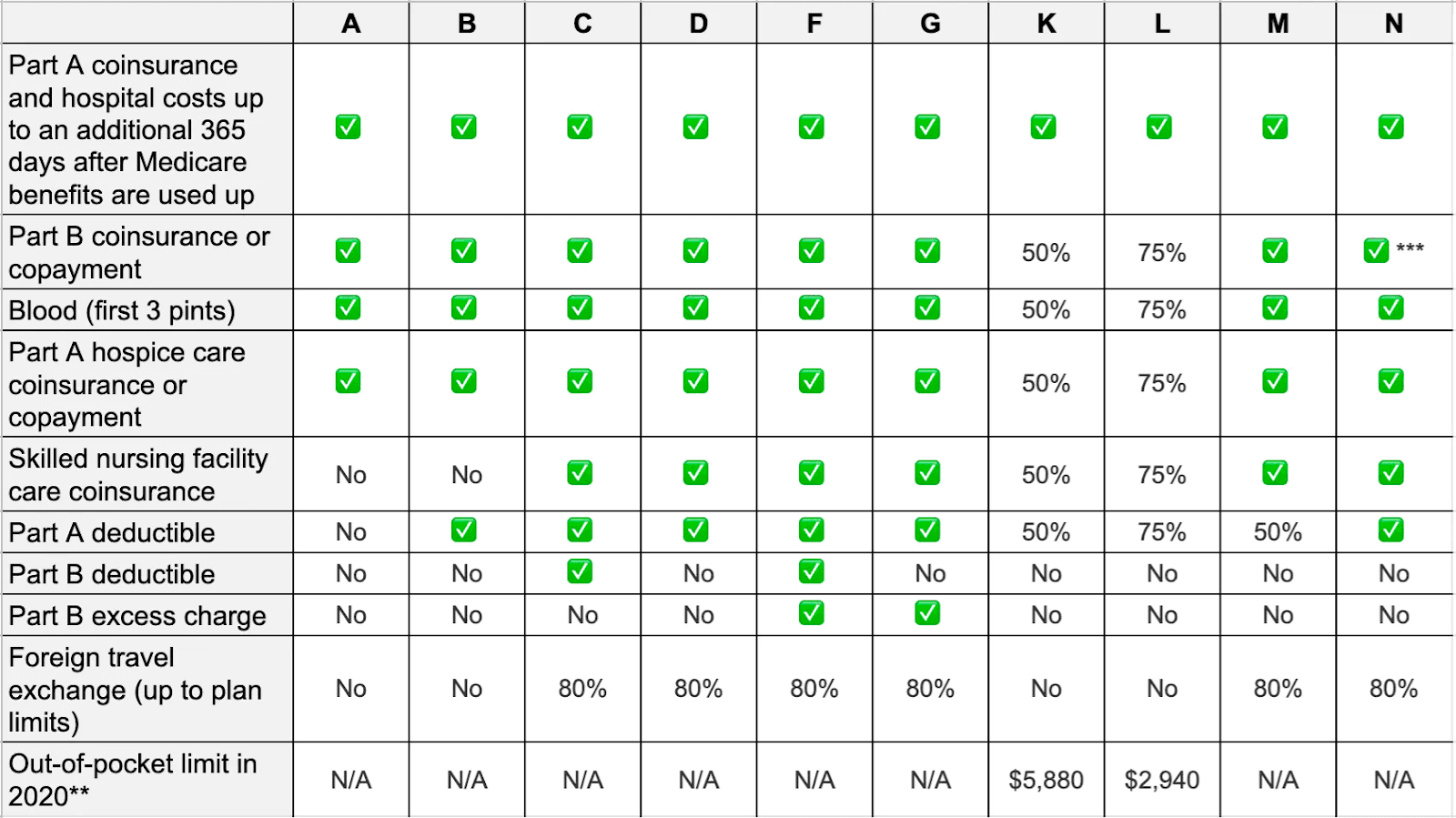

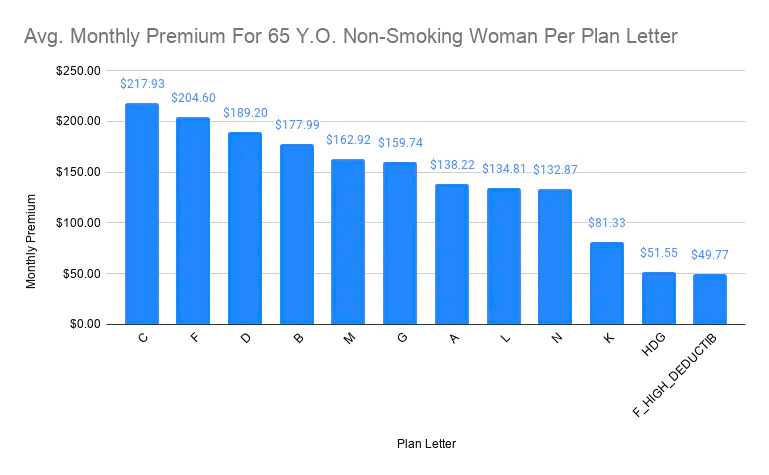

Comparing Medicare Supplement Plans

comparing Medigap plans

:The only difference between Plan F and G is that the former covers the $226 Medicare Part B deductible. However, Plan F costs, on average, about $50 more per month than Plan G. No point in paying an extra $600 a year for $226 in savings.

Tips for Choosing the Right Plan

speak with a licensed Medicare advisor at Fair Square

. Our agents have years of experience and are licensed to sell in all 50 states. Different states have different rates for the same plan letters, so do your diligence when researching and shopping around.

Conclusion

Stay Up to Date on Medicare!

Recommended Articles

More of our articles

14 Best Ways for Seniors to Stay Active in Nashville

15 Best Ways for Seniors to Stay Active in Denver

2024 "Donut Hole" Updates

Building the Future of Senior Healthcare

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Have Two Primary Care Physicians?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Fosamax?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Inqovi?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Oxybutynin?

Does Medicare Cover PTNS?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Tymlos?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Require a Referral for Audiology Exams?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Everything About Your Medicare Card + Medicare Number

Health Savings Accounts (HSAs) and Medicare

How Do Medicare Agents Get Paid?

How Do Medigap Premiums Vary?

How Does Medicare Cover Colonoscopies?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2023?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Choose a Medigap Plan

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

Is Botox Covered by Medicare?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is Gainswave Covered by Medicare?

Is HIFU Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Consulting Services

Medicare Explained

Medicare Guaranteed Issue Rights by State

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

The Fair Square Bulletin: August 2023

The Fair Square Bulletin: September 2023

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What is a Medicare Beneficiary Ombudsman?

What is the 8-Minute Rule on Medicare?

What is the Medicare ICEP?

What People Don't Realize About Medicare

When to Choose Medicare Advantage over Medicare Supplement

Why You Should Keep Your Medigap Plan

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M