Understanding the Different Medicare Plans, When to Enroll, and How

Stay Up to Date on Medicare!

34% of people

aren't familiar with Medicare, 64% don't know which part of Medicare to enroll in.What Is Medicare?

13.8 million people

re-enrolled in Medicare or signed up for the first time.Different Medicare Parts, How They Work, And What They Do

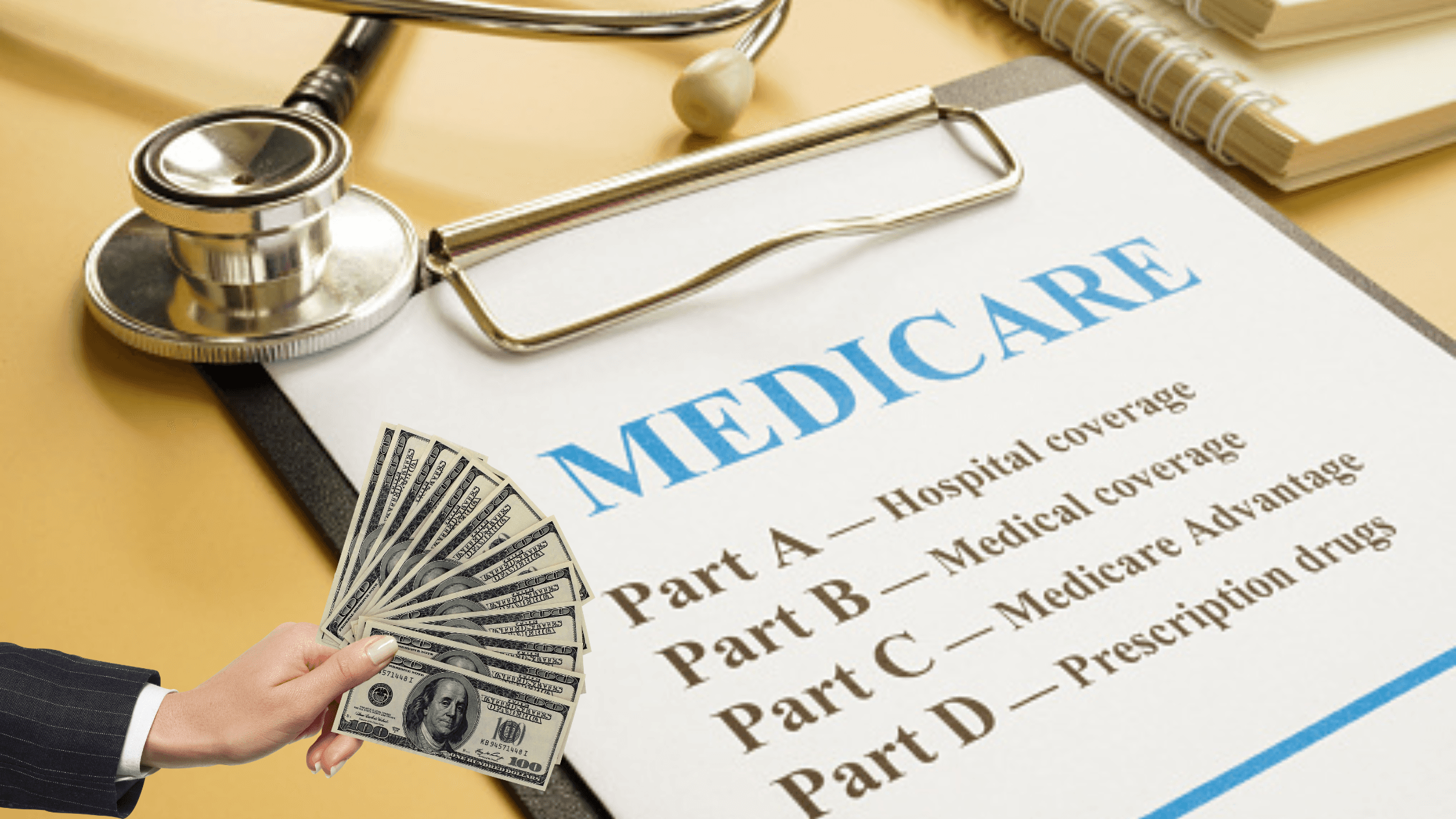

- Medicare Part A (Hospital Insurance): This covers inpatient hospital care, some skilled nursing care, hospice care, and home health care

- Medicare Part B (Medical Insurance): This covers outpatient care, doctor visits, medical equipment, and many preventive care services

- Medicare Part C (Medicare Advantage): This Medicare-approved plan is administered through private companies. It covers all services listed in Part A, Part B, and usually Part D

- Medicare Part D (Prescription Drug Coverage): This covers the cost of prescription drugs

Additional coverage

Medigap Plans (Medicare Supplements)

Medicare Advantage

When Do I Sign-up for Medicare?

What If I'm Collecting Retirement Benefits?

What If I'm Receiving Disability Benefits?

What If I Don't Have Retirement Benefits?

- A Medicare Supplement Insurance Plan

- A Medicare Prescription Drug Plan

- A Medicare Advantage Plan

When Can I Sign Up For a Medigap?

Other Medicare Enrollment Periods

The Medicare Special Enrollment Period

COBRA

nor retiree health coverage qualifies for SEP because they are not considered current employee coverage. You may want to enroll during your IEP if either of these situations applies to you.Annual Enrollment Period

- Shift from a Medicare Supplement Plan to a Medicare Advantage Plan

- Shift from a Medicare Advantage Plan back to Original Medicare

- Shift from one Medicare Advantage Plan to another Medicare Advantage Plan

- Shift from one Prescription Drug Plan to another

- Enroll in Medicare Part D

- Unenroll from a Prescription Drug Plan

Open Enrollment Period

- Shift from one Medicare Advantage Plan to another.

- Unenroll from a Medicare Advantage Plan and enroll in Original Medicare (with or without Part D).

Initial Coverage Election Period

What's Medicare Prescription Drug Coverage, and When Do I Sign Up?

- The Initial Enrollment Period (IEP)

- The Annual Enrollment Period

- The Open Enrollment Period

- Initial Coverage Election Period

How Do I Sign-up for Medicare?

- You can apply online at the

Social Security website

. - You can call your local Social Security office or their toll-free Number at 1-800-772-1213, Monday-Friday, 8:00 a.m. to 7:00 p.m.

- You can visit your Social Security office in person.

- You can call Fair Square Medicare at 1-888-376-2028. We can walk you through the whole process, step by step.

apply for Medicare

.Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways to Stay Active in Charlotte

2024 "Donut Hole" Updates

Are Medicare Advantage Plans Bad?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Help with the Cost of Tyrvaya?

Comparing All Medigap Plans | Chart Updated for 2023

Do I Need to Renew My Medicare?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Nexavar?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover PTNS?

Does Medicare Cover Qutenza?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Cover Tymlos?

Does Medicare Cover Xiafaxan?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare pay for Opdivo?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Estimating Prescription Drug Costs

How Can I Get a Replacement Medicare Card?

How Much Does Xeljanz Cost with Medicare?

How to Become a Medicare Agent

How to Choose a Medigap Plan

How to Enroll in Social Security

Is Botox Covered by Medicare?

Is HIFU Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medicare Explained

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

Seeing the Value in Fair Square

Should You Work With A Remote Medicare Agent?

The Fair Square Bulletin: July 2023

The Fair Square Bulletin: October 2023

Welcome to Fair Square's First Newsletter

What Is Medical Underwriting for Medigap?

What is the 8-Minute Rule on Medicare?

What Is the Medicare Birthday Rule in Nevada?

What You Need to Know About Creditable Coverage

What's the Deal with Flex Cards?

Which Medigap Policies Provide Coverage for Long-Term Care?

Why Is Medicare So Confusing?

Will Medicare Cover Dental Implants?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M