Choose a Medigap Plan that's Right for You

Stay Up to Date on Medicare!

Medicare Part A and Part B

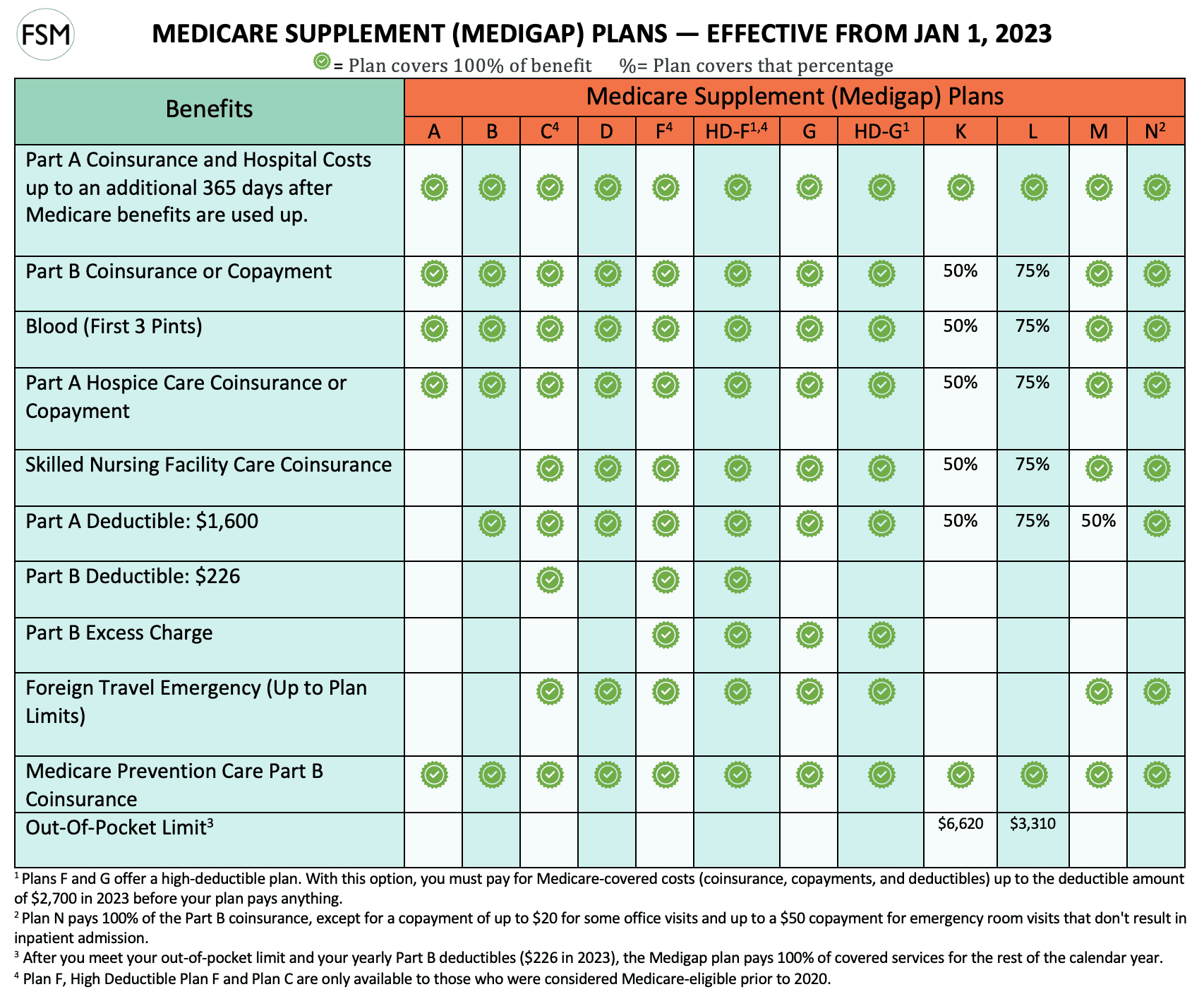

are mandatory, you can choose your Medigap plan. Medigap coverage starts where your Medicare coverage stops. It fills in the gaps.What Is a Medigap Plan?

deductibles, copays, and coinsurance

. Medigap, also known as Medicare Supplement Insurance, helps to meet these out-of-pocket expenses.traveling outside the United States

.How Do I Compare Different Medigap Plans?

Medicare SELECT plan

. Although this plan may have a lower premium, there are network limitations.How Much Does a Medigap Plan Cost?

cost of Medigap plans

can vary depending onthe plan you choose

and the insurance provider. The premium amount, which is the monthly price you pay for the plan, can range from $50 to more than $400.- Part A/B premium

- Medigap plan premium

- Deductibles — The amount you pay before your insurance coverage begins

- Copayments — The amount you pay as your share for services after paying any deductibles, usually a percentage

- Coinsurance — The amount you pay as your share for a medical service

Do Medigap Plans Have Network Limitations?

Medigap plans in Massachusetts, Minnesota, and Wisconsin

Massachusetts

,Minnesota

andWisconsin

. These three states have their own unique Medigap plans.When Do You Enroll in a Medigap Plan?

enroll in Medigap

, you can do it any time throughout the year after you've enrolled in Medicare Parts A and B.Initial Enrollment Period

(IEP) has the advantage of getting better premium rates and more plan options. Moreover, you can choose any plan you like withoutmedical underwriting

, even if you have a health condition.Takeaway

provide an unbiased opinion

and assist you in selecting the best plan for your needs.Stay Up to Date on Medicare!

Recommended Articles

More of our articles

14 Best Ways for Seniors to Stay Active in Seattle

20 Questions to Ask Your Medicare Agent

2024 "Donut Hole" Updates

Building the Future of Senior Healthcare

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do I Need Medicare If My Spouse Has Insurance?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Ilumya?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Nuedexta?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Vitamins?

Does Medicare Cover Wart Removal?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Funeral Expenses?

Does Medicare Require a Referral for Audiology Exams?

Does Your Plan Include A Free Gym Membership?

How Are Medicare Star Ratings Determined?

How Does Medicare Cover Colonoscopies?

How is Medicare Changing in 2023?

How Much Does Medicare Part A Cost in 2023?

How Much Does Medicare Part B Cost in 2023?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Become a Medicare Agent

How to Deduct Medicare Expenses from Your Taxes

Is Balloon Sinuplasty Covered by Medicare?

Is Emsella Covered by Medicare?

Is PAE Covered by Medicare?

Medicare & Ozempic

Medicare Advantage MSA Plans

Medicare Consulting Services

Medicare Explained

Medicare Savings Programs in Kansas

Plan G vs. Plan N

Seeing the Value in Fair Square

Should You Work With A Remote Medicare Agent?

The Easiest Call You'll Ever Make

The Fair Square Bulletin: June 2023

Top 10 Physical Therapy Clinics in San Diego

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Advantage POS Plan?

What Is Medical Underwriting for Medigap?

What Is the Medicare Birthday Rule in Nevada?

What to Do When Your Doctor Doesn't Take Medicare

What's the Deal with Flex Cards?

Why You Should Keep Your Medigap Plan

Will Medicare Cover it?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M