If they've got creditable coverage, you can stick with your insurance plan

Stay Up to Date on Medicare!

First Rule of Thumb

check out our article here

. Your spouse's private insurance coverage is creditable if they work for a company with at least 20 employees. When weighing your options, your first question should be the size of the company providing your insurance. If your spouse works somewhere with less than 20 employees, it’s important to ask their HR representative if the insurance is creditable. If you don’t have creditable coverage, you should apply for Medicare Part A and Part B. And if you decide at any point that private insurance is not a good fit for you anymore, you can always shop for Medicare once you're eligible.Fair Square Medicare

is the place to find your best plan. For now, all you need to know is if you have creditable coverage, stick with it.Primary vs. Secondary

Medicare

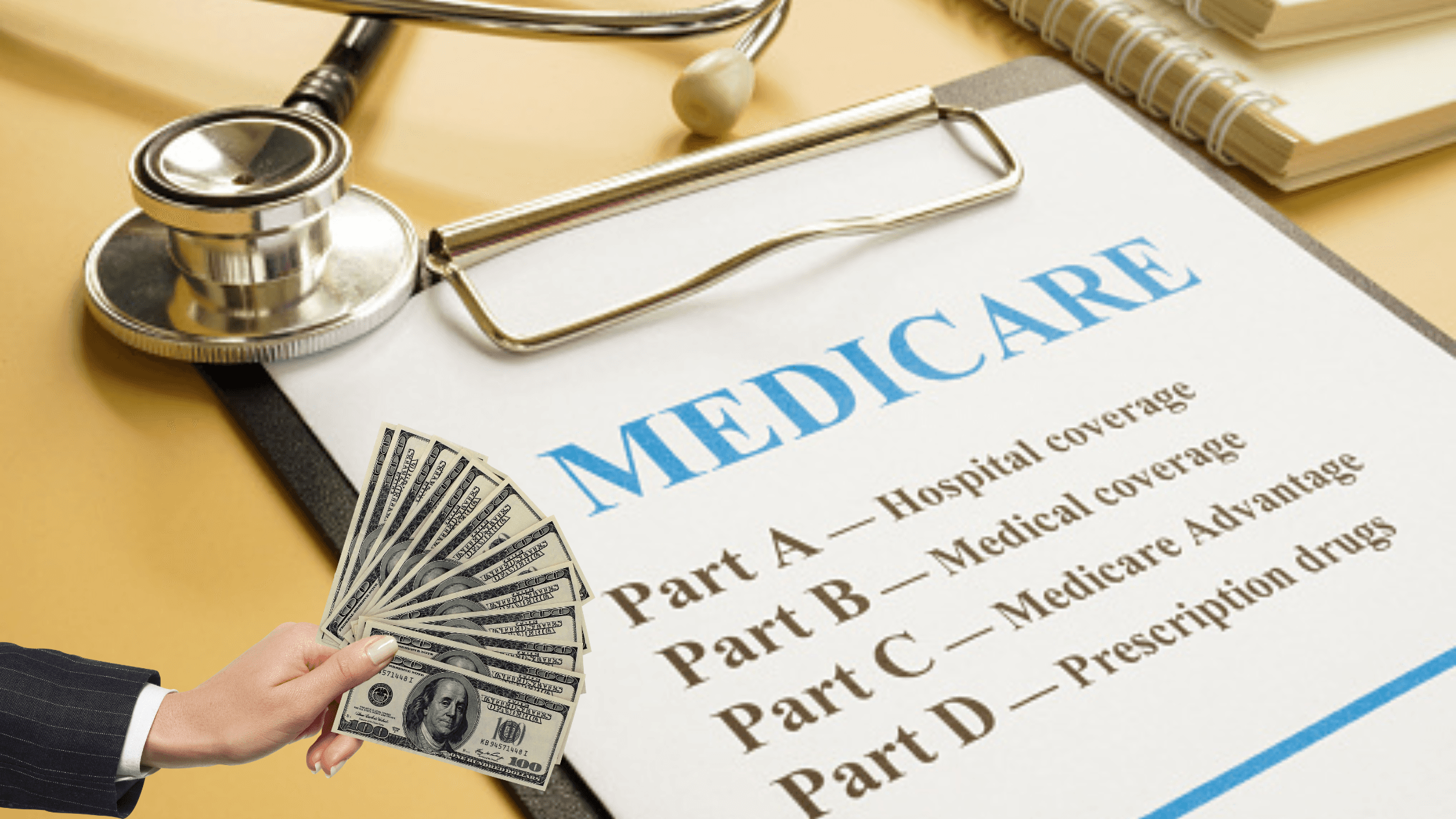

, Medicare pays secondary and is supplementing your employer insurance. For whatever healthcare costs pop up, your insurance takes the first swing, and if anything is leftover, Medicare comes in to cover the rest. Remember that Medicare will only pay for things covered by Medicare.Part A of Medicare

even if they have creditable coverage. That's because it's free (as long you or your spouse have paid 40 quarters' worth of social security taxes) to get more secondary coverage.Group Health Plans

Coordination of Benefits

What about your prescription drug coverage?

Part D

. But as long as you have creditable coverage, you have a special enrollment period of 63 days after your coverage ends to enroll without penalty.What if you or your spouse have a retirement plan?

- If you’ve got a retirement plan, your spouse’s GHP, and Medicare, it pays as follows:

- 1. GHP

- 2. Medicare

- 3. Retirement Plan

Takeaway

Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Seattle

20 Questions to Ask Your Medicare Agent

2024 Medicare Price Changes

Building the Future of Senior Healthcare

Can Doctors Choose Not to Accept Medicare?

Can I Choose Marketplace Coverage Instead of Medicare?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover COVID Tests?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Fosamax?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Inqovi?

Does Medicare Cover Krystexxa?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mental Health?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Nuedexta?

Does Medicare Cover Qutenza?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Wart Removal?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Varicose Vein Treatment?

Does Medicare Require a Referral for Audiology Exams?

Explaining the Different Enrollment Periods for Medicare

Finding the Best Vision Plans for Seniors

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Pay for Emergency Room Visits?

How Medicare Costs Can Pile Up

How Much Does Medicare Part A Cost in 2023?

How Much Does Medicare Part B Cost in 2023?

How Much Does Open Heart Surgery Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Become a Medicare Agent

How to Choose a Medigap Plan

How to Deduct Medicare Expenses from Your Taxes

Is Balloon Sinuplasty Covered by Medicare?

Is Emsella Covered by Medicare?

Is HIFU Covered by Medicare?

Is PAE Covered by Medicare?

Medicare Consulting Services

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

What Is a Medicare Advantage POS Plan?

What is a Medicare Beneficiary Ombudsman?

What is the 8-Minute Rule on Medicare?

What's the Deal with Flex Cards?

What's the Difference Between HMO and PPO Plans?

When to Choose Medicare Advantage over Medicare Supplement

Why Is Medicare So Confusing?

Why You Should Keep Your Medigap Plan

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M