Deducting Medicare expenses helps you get the most out of your tax return

Stay Up to Date on Medicare!

Are Medicare Expenses Tax Deductible?

Medicare

expenses from your tax returns if you meet the eligibility requirements.

How Much Can I Deduct From My Taxes?

- Adjusted Gross Income (AGI)

- Medicare expenses

- For example, you have $5,000 in medical expenses, and your AGI is $40,000. You can claim a deduction for any amount over $3,000 (i.e., 7.5% of $40,000)

- $40,000 x 7.5% = $3,000

- $5,000 - $3,000 = $2,000

What Medicare Expenses Are Tax Deductible?

Medicare Part A

premium- Most people are not required to pay the Medicare Part A premium because they or their spouse have paid Medicare taxes while working. However, if you're required to pay the Part A premium and are not yet collecting Social Security benefits, you may be able to claim a tax deduction for these premiums

- Medicare Part B premium

- Medicare Part D premium

- Medicare Advantage (Part C) premium

Medigap

premiumLong-term care

insurance premium- You may be able to deduct a portion of your long-term care insurance premiums on your taxes based on your age. The amount varies depending on age and ranges from $450 for those 40 or younger to $5,640 for those 71 or older

- Co-pays, deductibles and coinsurance for Part A, B or D services

- Acupuncture

- Ambulance services

- Annual Physical Examination

- Cars

- Vehicle modification costs for a disabled driver

- Costs incurred to modify a car for wheelchair users, including interior and exterior changes

- Transportation costs for medical appointments, such as the cost of gas and oil

- Dental services

- Eye exams & eyeglasses

- Crutches

- Home Improvements

- Weight-loss programs

- Wheelchairs

- X-ray services

What Medical Expenses Are Not Tax Deductible?

- Nonprescription Drugs

- Except for insulin, nonprescription drugs (e.g., over-the-counter medications and nutritional supplements) generally don't qualify for tax deductions

- Late enrollment penalties

- Electrolysis, or hair removal

- Babysitting or childcare

- Health Club Dues

- Hair transplants

- Personal use items (toothbrushes, floss, toilet paper, etc.)

- Teeth whitening

- Weight loss program

- Veterinary fees

How Do I Deduct Medical Expenses From My Taxes?

1. Keep Track of Your Medicare Expenses

2. Calculate Your Deduction

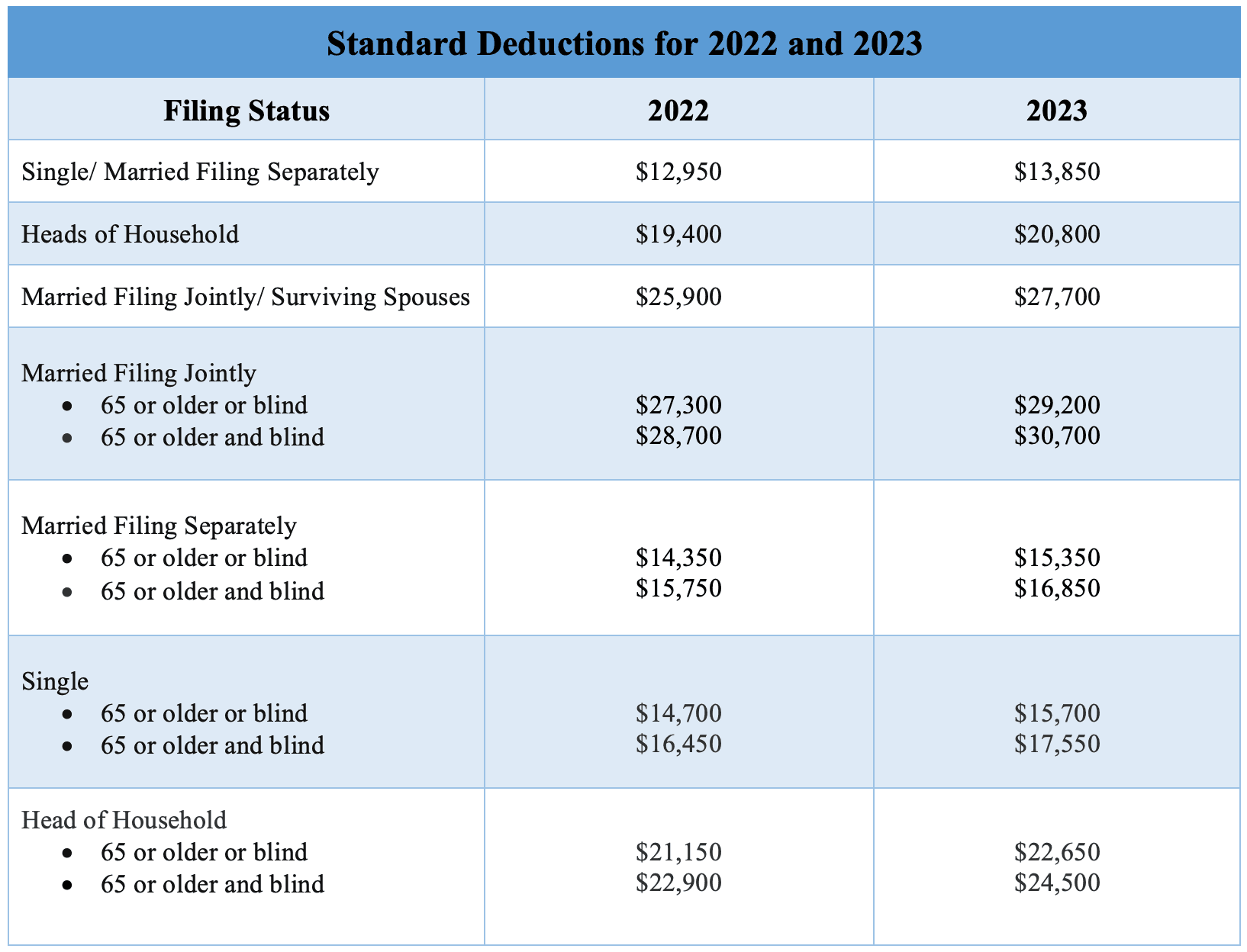

3. Itemize if You Are Eligible

Form 1040

, Schedule A.4. Claim the Deduction on Your Tax Return

Takeaway

- Keep track of your Medicare expenses

- Calculate your deduction

- Itemize if you're eligible

- Claim the deduction on your tax return

Fair Square Medicare

, we'll help you identify tax-deductible expenses that will bring you financial relief.Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

Building the Future of Senior Healthcare

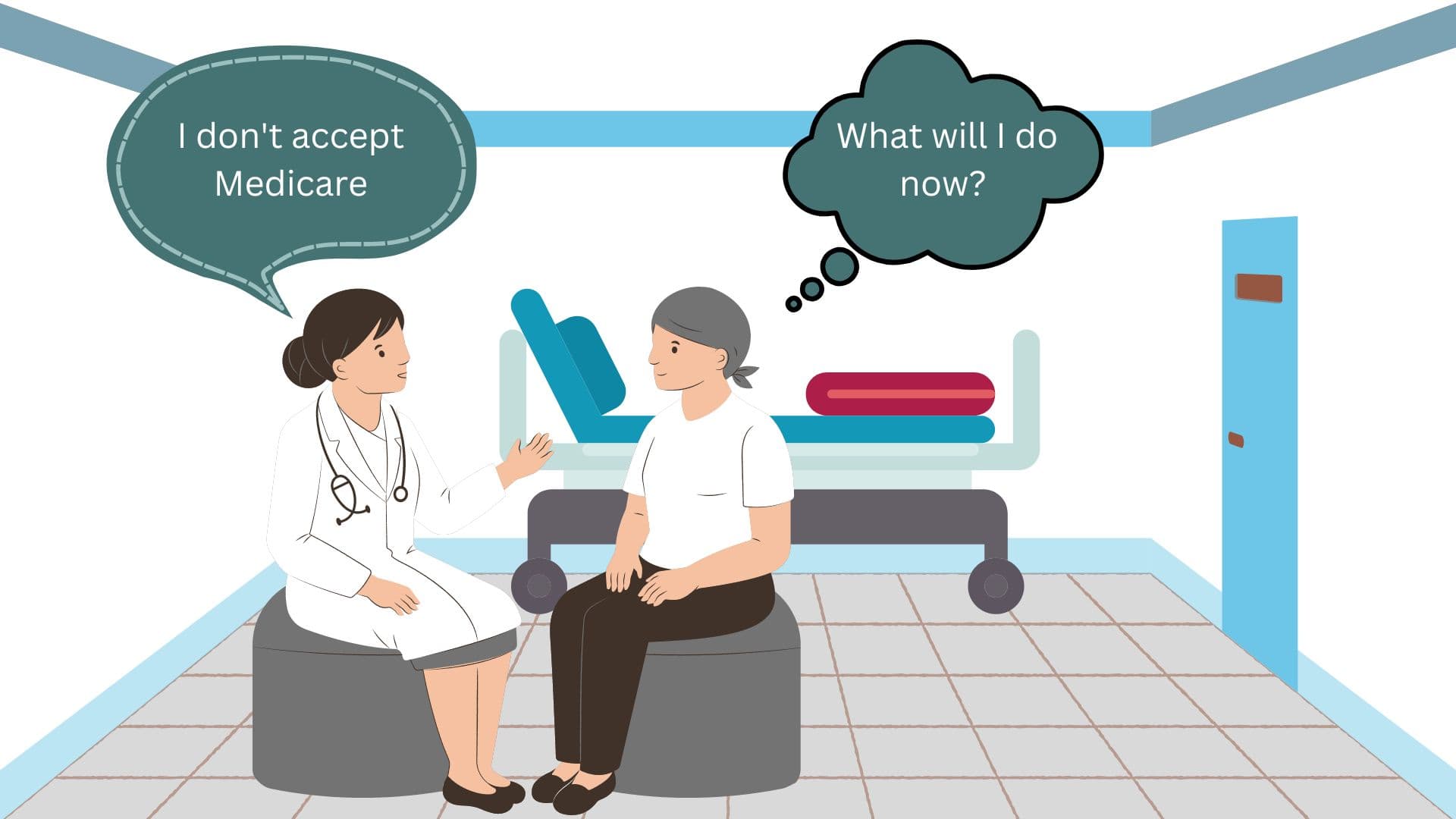

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do All Hospitals Accept Medicare Advantage Plans?

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover Abortion Services?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Ilumya?

Does Medicare Cover Jakafi?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Nexavar?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Pay for Funeral Expenses?

Does Medicare Pay for Varicose Vein Treatment?

Does Your Medicare Plan Cover B12 Shots?

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How Do Medicare Agents Get Paid?

How Do Medigap Premiums Vary?

How Does Medicare Cover Colonoscopies?

How is Medicare Changing in 2023?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Cost?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Enroll in Social Security

Is Displacement Affecting Your Medicare Coverage?

Is Vitrectomy Surgery Covered by Medicare?

Medicare 101

Medicare Supplement Plans for Low-Income Seniors

Should You Work With A Remote Medicare Agent?

The Easiest Call You'll Ever Make

The Fair Square Bulletin: July 2023

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

What Happens to Unused Medicare Set-Aside Funds?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What People Don't Realize About Medicare

When Can You Change Medicare Supplement Plans?

Which Medigap Policies Provide Coverage for Long-Term Care?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M