Medicare commissions should not affect your choice of plan

receive expert advice at no cost.

This might beg the question, “if you are not being paid by clients for your services, how do Medicare agents get paid?” The short answer is Medicare Brokerages are paid via commissions from insurance companies when clients enroll in certain plans. In this blog post, we will talk through how Medicare agents are paid by commission and how we atFair Square

separate ourselves from other Medicare brokerages.Stay Up to Date on Medicare!

What is a Medicare Brokerage?

CMS

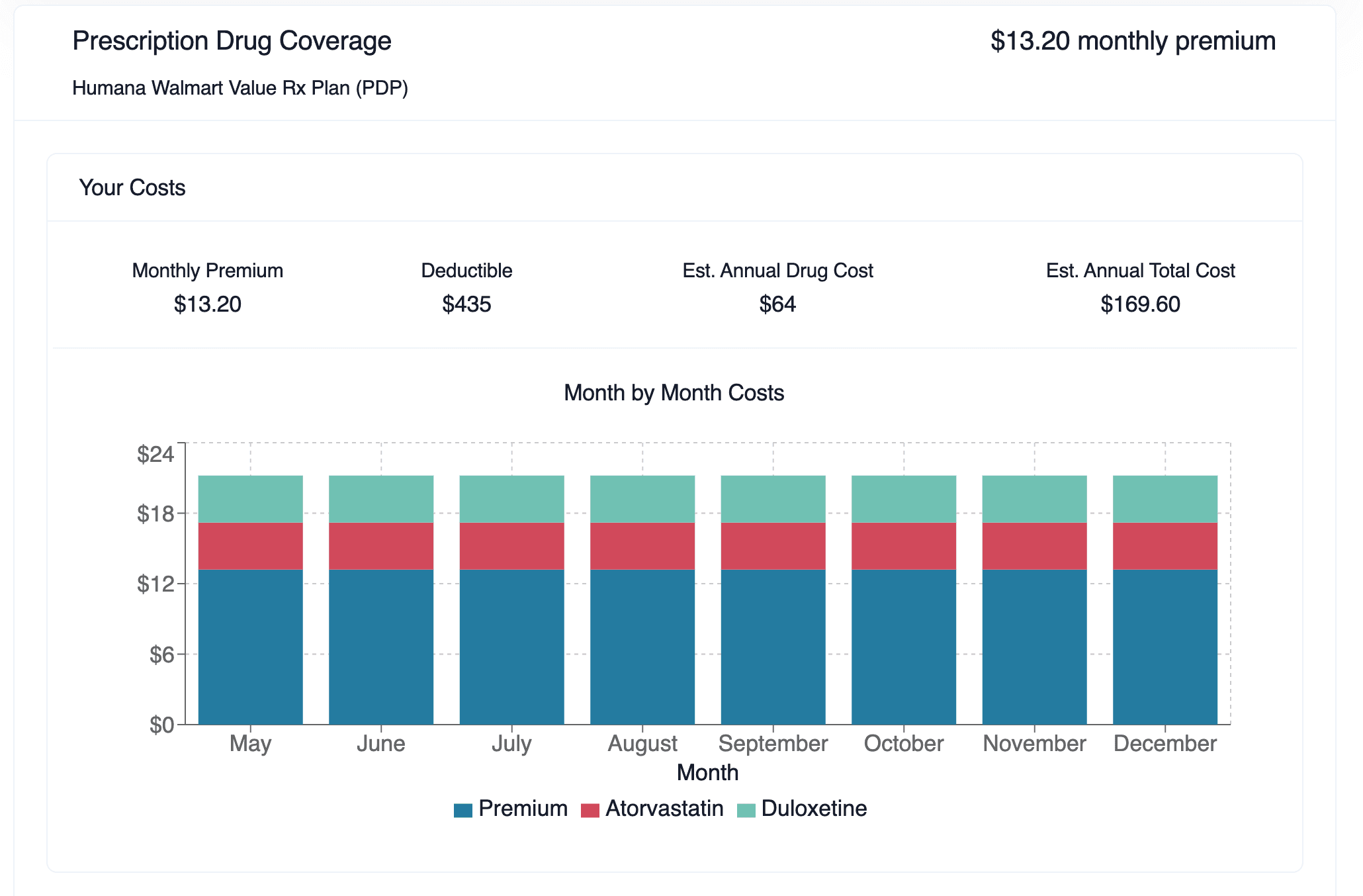

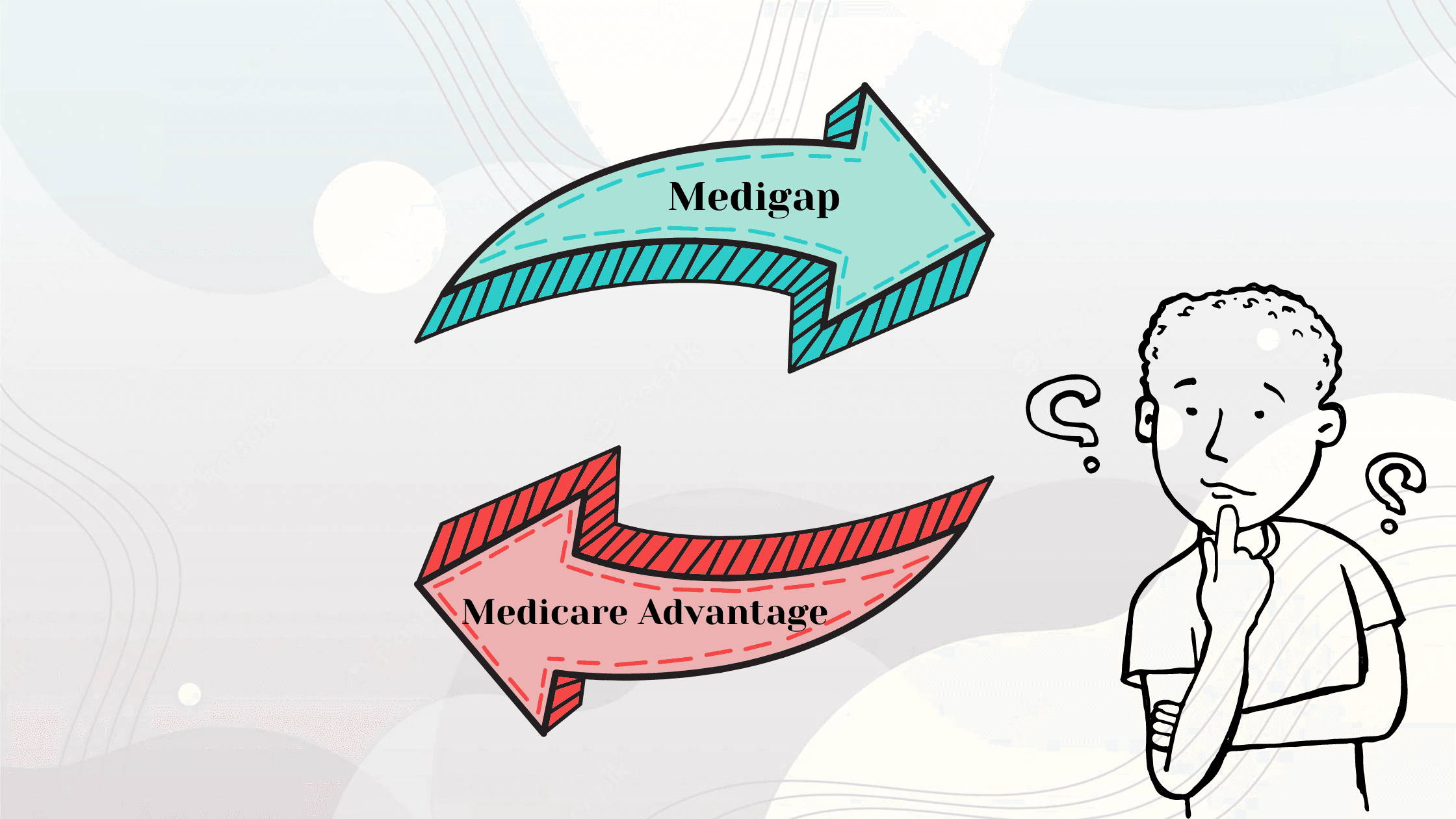

) and work with multiple insurance companies to provide beneficiaries with a range of plan options. A brokerage can provide information and guidance onMedicare Advantage plans

(aka Part C),Medicare Supplement plans

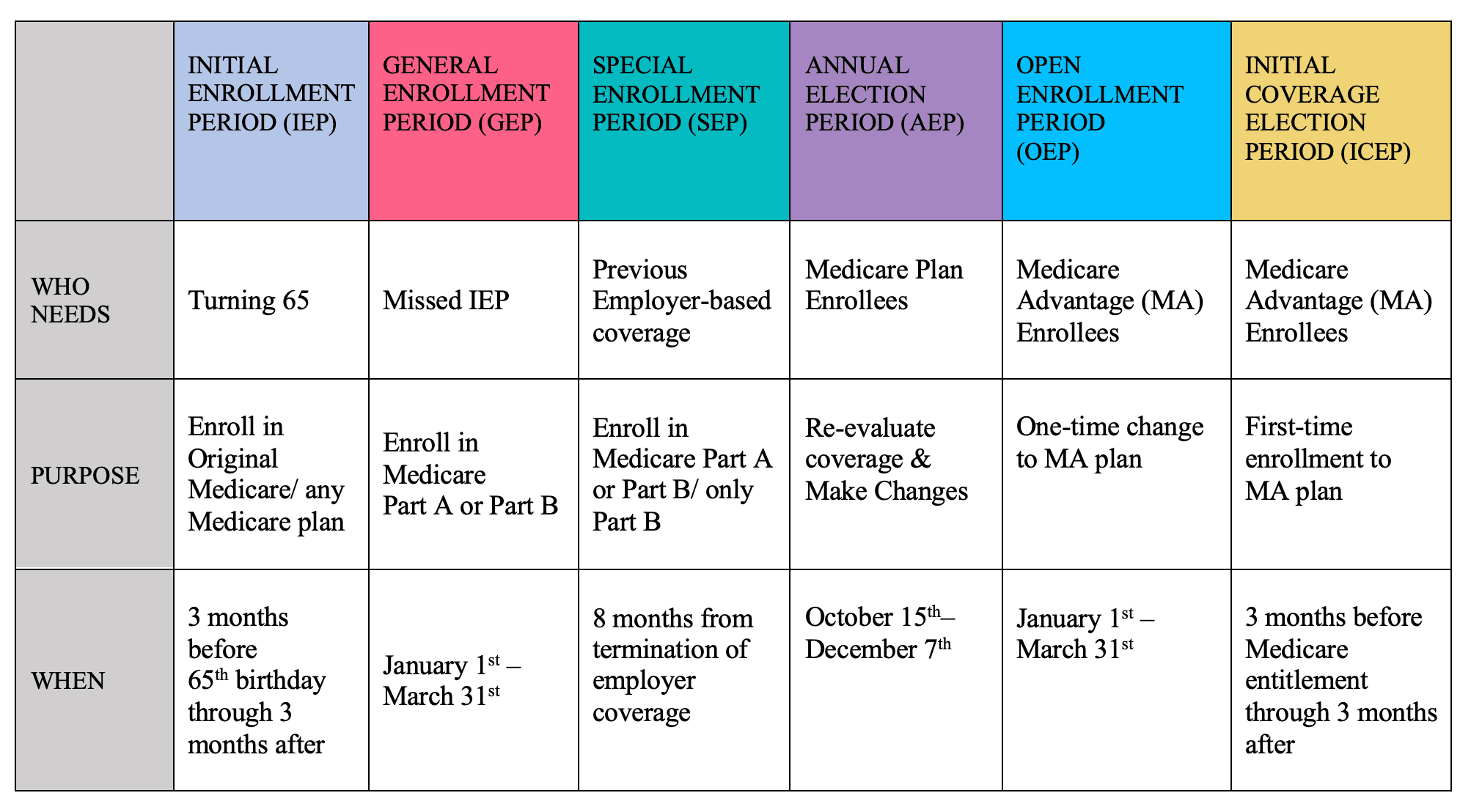

(aka Medigap), and Part D Prescription Drug plans. Medicare brokerages can also assist beneficiaries in comparing plans, understanding plan benefits and costs, and navigating the enrollment process. Brokerages may receive commissions or fees for their services, which can be paid by insurance companies or by beneficiaries themselves. There are plenty of brokerages out there, so you should pick the one that has your best interest in mind.How Medicare Agents Get Paid

Factors That Affect Medicare Brokerage Payment

Why Medicare Beneficiaries Should Care About How Medicare Brokerages Get Paid

Fair Square

, we separate ourselves from other Medicare brokerages because our agents are commission neutral. This means their compensation is the same no matter which plan you choose. We believe it's better business to get you on the best possible plan that you will want to stay with for many years than to try to make money off of our clients with high-commission plans that they will want to switch in a year or two.Conclusion

Stay Up to Date on Medicare!

Recommended Articles

More of our articles

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Seattle

Are Medicare Advantage Plans Bad?

Can Doctors Choose Not to Accept Medicare?

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need to Renew My Medicare?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Does Medicare Cover Abortion Services?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mental Health?

Does Medicare Cover Nexavar?

Does Medicare Cover Nuedexta?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover Piqray?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Service Animals?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover TENS Units?

Does Medicare Cover Tymlos?

Does Medicare Cover Urodynamic Testing?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Does Medicare Pay for Varicose Vein Treatment?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Plan Include A Free Gym Membership?

Explaining IRMAA on Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Fair Square Client Newsletter: AEP Edition

How Are Medicare Star Ratings Determined?

How Do Medigap Premiums Vary?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Cost?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Become a Medicare Agent

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Emsella Covered by Medicare?

Is Gainswave Covered by Medicare?

Is PAE Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Advantage Plans for Disabled People Under 65

The Fair Square Bulletin: July 2023

The Fair Square Bulletin: The End of the COVID Emergency Declaration

What Are Medicare Part B Excess Charges?

What Happens to Unused Medicare Set-Aside Funds?

What Is Medical Underwriting for Medigap?

What is the 8-Minute Rule on Medicare?

What to Do When Your Doctor Doesn't Take Medicare

What You Need to Know About Creditable Coverage

Which Medigap Policies Provide Coverage for Long-Term Care?

Why Is Medicare So Confusing?

Will Medicare Cover Dental Implants?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2022 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M